WTI Oil prices plummeted below $40 at the end of the week following OPEC’s decision to keep production levels unchanged during their latest meeting in Vienna. Any optimism over a possible production cut diminished rapidly when the group failed to agree on a production ceiling, leaving current production at 31.5M barrels per day. With concerns elevated around the aggressive oversupply in the markets, investor sentiment will remain haunted towards WTI Oil in the short-term and selling in the commodity will resume. This will consequently add pressures to those currencies that belong to economies which are reliant on oil exports.

WTI Oil remains fundamentally bearish and the ongoing indications that OPEC is willing to leave production levels unchanged despite a continuous oversupply in the hope of regaining market share will leave prices vulnerable to further losses. WTI Oil suffers from a dangerous combination of an excessive oversupply and sluggish global demand in the markets which has consistently weighed heavily on investor sentiment.

From a technical standpoint on the daily timeframe, WTI is heavily bearish as there have been consistent lower lows and lower highs on the charts. Prices have managed to breach the psychological $40 support and this may encourage sellers to send prices towards the next relevant support at $39. Lagging indicators such as the daily 20 SMA and MACD, which also point downwards, compliment this bearish view.

Optimism around the prospects of a December US interest rate rise received reinforcement on Friday after November’s NFP report exceeded expectations at 211k. US economic data are looking strong and November showed positive results - as a result, the markets are heavily weighing in favour of a US interest rate rise this month. Sentiment towards the USD is bullish and with the Fed futures illustrating a near 80% possibility that the Fed may raise US interest rates, Dollar strength should take centre stage in the global currency markets.

EURUSD aggressively bounces

The ECB’s under delivery on the implementation of measures to raise inflation as quickly as possible sparked an aggressive 3.3% bounce in the EURUSD during Thursday’s trading session. Disappointed market participants discarded the news that the ECB would extend QE until March 2017, because they were hoping for far more than this from the ECB.

The Eurozone’s 2% inflation target continues to face headwinds from factors like the fall in commodity prices, but this did not offer a compelling argument for the ECB to unleash a higher quantity of QE quite yet. Although the ECB are still saying further QE is possible, market participants are very disappointed with the Central Bank at present and anything that is said by Draghi and other policy members could be taken with a pinch of salt until at least the turn of the year.

Traders will continue to look at the existing divergence in both economic sentiment and monetary policy between the United States and Europe, which should encourage sellers to attack the EURUSD once they get over the disappointment from the ECB decision. Even though Friday’s positive NFP release only caused a minor decline in the EURUSD, as long as the Fed raise US interest rates in December, this should in theory encourage sellers to send the EURUSD back towards its lows around 1.05.

EURUSD

The EURUSD is technically bullish on the daily timeframe. Prices aggressively surged on Thursday following the ECB’s under delivery on the implementation of measures to raise inflation as quickly as possible, and this installed Euro bulls with inspiration. A breakdown below 1.082 may encourage sellers to send prices back towards 1.050.

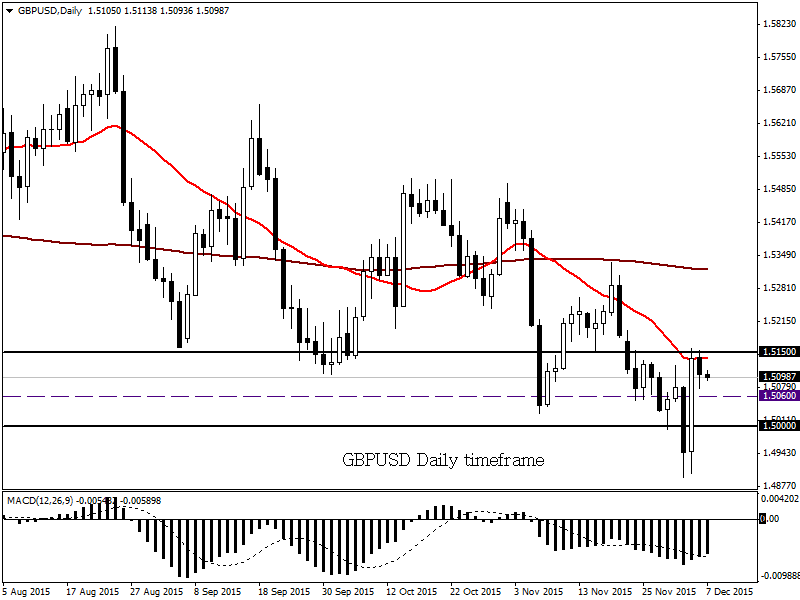

GBPUSD

Despite the hefty appreciation which the GBPUSD experienced on Thursday, this pair remains bearish as long as prices can keep below the 1.515 resistance. The candlesticks still reside below the daily 20 SMA and the MACD trades to the downside. A breakdown below 1.506 may encourage sellers to send prices back towards 1.500.

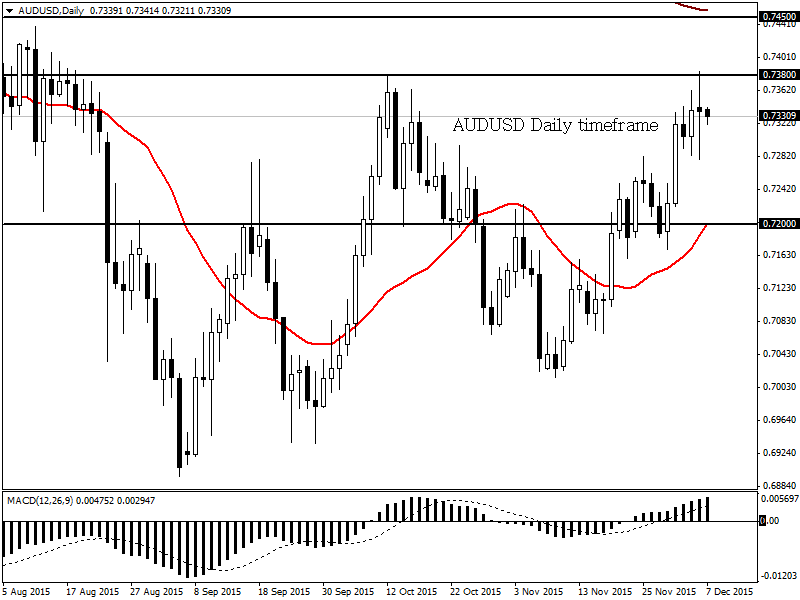

AUDUSD

The AUDUSD is technically bullish on the daily timeframe as there have been consistent higher highs and lows since the breach above 0.7200. A breakout above 0.7380 should encourage buyers to attack the pair towards 0.7450.

USDJPY

The USDJPY is in a phase of consolidation on the daily timeframe. A breakout above the 123.50 resistance may open a path towards 125.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.