Global Market

With the continuation of the China saga, global sentiment received another dent as GDP growth for the world’s second largest economy in Q3 fell short of the golden 7% figure. Although GDP rose to 6.9% beating the 6.8% forecast, this was still the slowest quarterly growth expansion since the first three months in 2009. Not only have concerns been renewed about the pace of growth in China, the GDP figure of 6.9% has restored fresh debates over the accuracy of China’s growth statistics with fears that the GDP growth is even lower than what the official statistics dictate. Sentiment remains bearish for China and the China market will be open to more downward pressures in 2015.

Asian equities were open to losses and have edged back into red territory with the Shanghai Composite Index trading -1.03% as of writing. There may be a case of Monday market blues originating from the soft China data which may result in European and American equities venturing back into red territory in Monday’s trading session.

The radiating risk from China will trickle back down to the United States, as the Fed has been offered another reason to hold off the already fading expectations of a 2015 US rate hike. This will translate to USD vulnerability this week with the Dollar Index potentially declining back to the 94.00 support. Whilst the USD may decline, the risk-off environment derived from anxious market participants may empower upside momentum within safe haven assets such as Gold. This precious metal has enjoyed an extended move to the upside as a result of USD weakness combined with a lack of clarity provided by the Fed on the topic of a US rate hike. The soft data from China may act as a catalyst which should provide a foundation to send Gold back above last week’s highs of 1191.50 with targets of the next relevant resistance at 1200.00.

The next major focus this trading week will be on Tuesday when BoE Carney discusses the health of the UK economy and possible subtle clues on when rates may be hiked in the UK. The deflationary CPI reading of -0.1% in October combined with the chain of negative PMI releases in September offer a solid argument as to why the BoE may not hike UK rates until the middle of 2016.

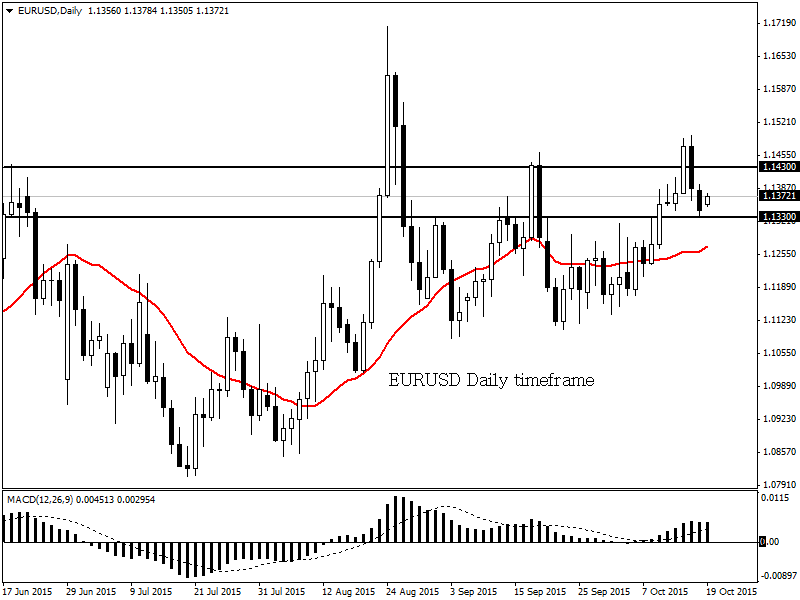

EURUSD

The EURUSD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above the 1.1330 support, there may be an incline back to the 1.1430 level.

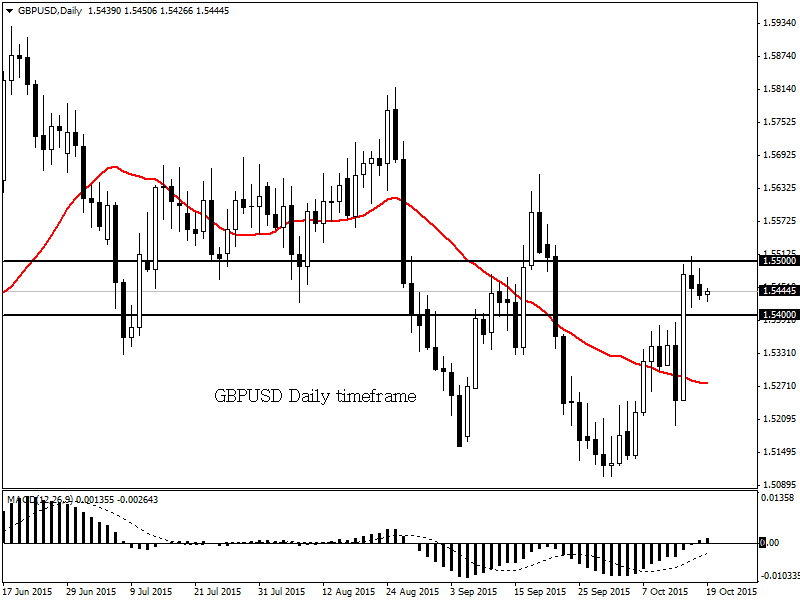

GBPUSD

The GBPUSD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above the 1.5400 support, prices may incline back to the 1.5500 resistance.

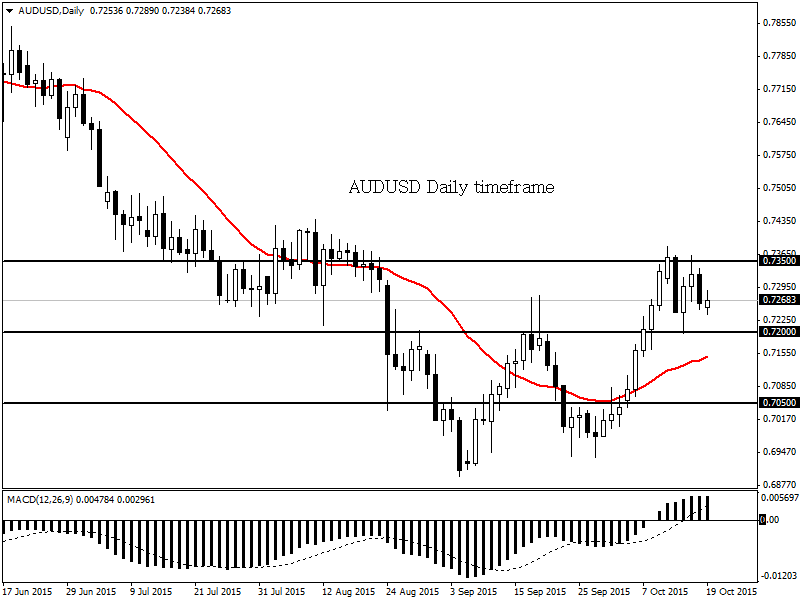

AUDUSD

The AUDUSD currently resides in a wide range. Resistance can be found at 0.7350 and support can be found at 0.7200. A breakdown below the 0.7200 support may open a path to the next relevant support at 0.7050.

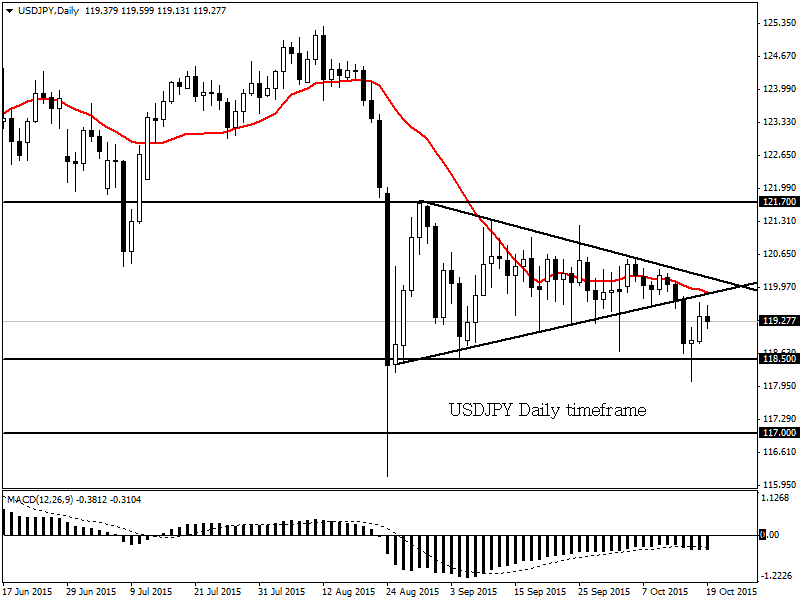

USDJPY

The USDJPY is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A strong breach below the 118.50 support may open a path to the next relevant support based at 117.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.