Global Market

Global sentiment was dealt a blow this week as soft economic data from China renewed the concerns about its slowing pace of growth. Following a slight decline in global equities, escalating expectations that further monetary policy from China may be impending has translated to Asian equities venturing into green territory. With the looming China Q3 GDP report taking the spotlight, Friday’s trading session may conclude with some built up anxiety as market participants ponder on the possible outcomes over the weekend. If the world’s second largest economy fails to achieve its 7% Q3 GDP targets then global sentiment may be dealt a frightening blow once again. This may translate to a strong decline in Asian equities in the new trading week, regardless of the expectations of further monetary policy from China.

Dollar weakness remains the main driver in the global currency markets. As long as the diminishing expectations of a US interest rate hike in 2015 remains the main concern, more downside pressure in the USD may be expected. If CPI for China on Monday falls short of the 7% target, this may trickle back down to the USD exposing it to further losses. The Dollar Index remains technically bearish on the daily timeframe and additional USD vulnerability may open a path within this index to the next relevant support at 93.30.

The potential decline in economic momentum in the UK, combined with the fact that the BoE will likely push back the interest rate increase deep into 2016 has left the GBP exposed. The GBP remains in a state of sensitivity and if the upside momentum slows down next week, a riskoff environment that may be renewed from a China CPI which fails to meet expectations may open the GBP to additional downside pressures.

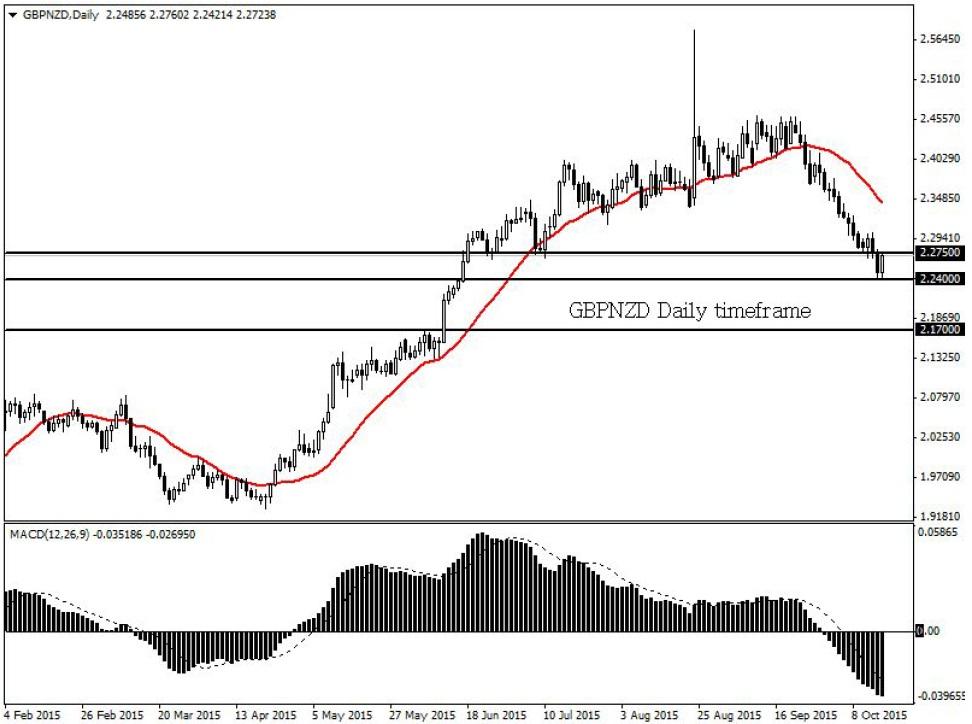

GBPNZD

The GBPNZD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The previous support at 2.2750 should act as a dynamic resistance. A breach below the 2.2400 level may open a path to the next relevant support at 2.1700.

SILVER

Silver is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above the 15.55 support, there may be an incline to the next relevant resistance at 16.60.

Dollar Index

The Dollar Index is technically bearish on the daily timeframe. A breakdown below the 94.00 support may open a path to the next relevant support at 93.30.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.