Global Markets

A bluntly spoken ECB Governor Nowotny took the opportunity to put a conclusion on the recent Euro rally by explicitly stating that the ECB was clearly missing their inflation target in Thursday’s trading session. Market participants understood this comment as a signal that more stimulus measures from the ECB will be coming in the near future, and as a result the EUR experienced a hefty selloff against the USD and across most of its counterparts. If Friday’s CPI release for Europe fails to meet expectations, this may simply compliment ECB Governor Nowotny’s comments and provide a final compelling case for the ECB to provide additional stimulus measures in the near future.

The ongoing weak sentiment towards the Dollar has refused to have a positive impact on WTI which has suffered four successive days of declines this week. The latest inventory report showed another huge stockpile and will further the continual concerns regarding oversupply. On top of this, weak data from both the US and China has fueled concerns over global growth, with this further pressuring the price of WTI. This commodity remains technically bearish on the daily timeframe and with the central theme of oversupply remaining unchanged, any additional fears about a reduction in demand for oil should send prices back to the magnetic $44.00 support.

NZDUSD

The NZDUSD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. Prices have hit the 0.6850 resistance this trading week. The next relevant resistance is based at 0.7000.

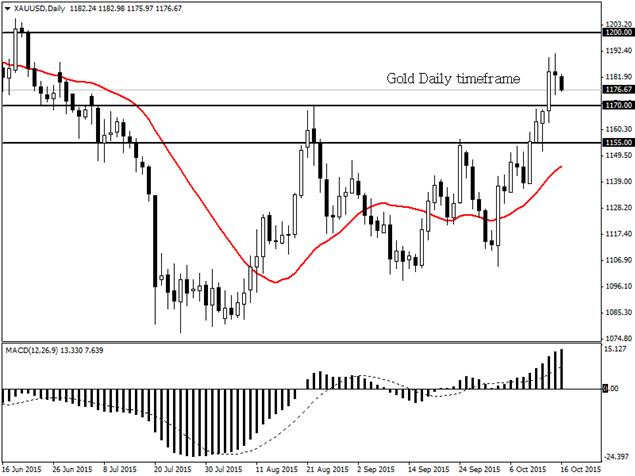

GOLD

Dollar weakness has instilled bullish momentum within Gold. This commodity is technically bullish on the daily timeframe. Previous resistance at 1170.0 may become dynamic support which should send prices to the next relevant resistance at 1200.0.

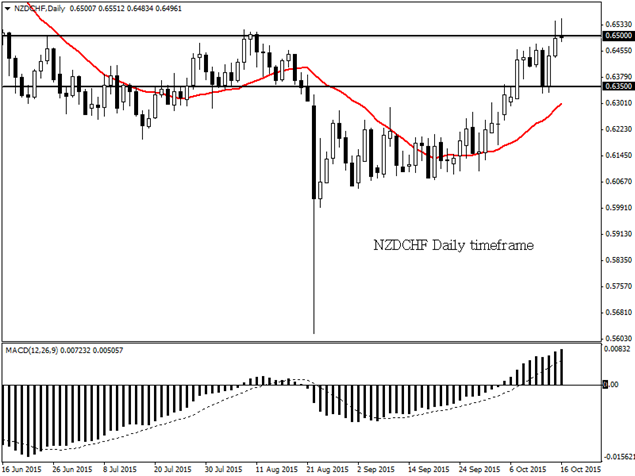

NZDCHF

The NZDCHF is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. A breach above the 0.6500 resistance may open a path to the next relevant resistance at 0.6700. A move back below 0.6350 suggests bullish weakness.

USDZAR

The USDZAR is technically bearish on the daily timeframe. As long as prices can keep below the 13.250 resistance there may be an additional decline to the next relevant support at 12.600.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.