Global Market

WTI bulls gained inspiration during Tuesday’s trading session when US government data suggested that the global oil supply glut could be diminishing. This unexpected news resulted in the commodity not only advancing $2 but achieving its highest value in over a month at $49.00. This stronger oil price should provide strength to currencies with export linked commodity exports. Despite the inspiration gained by WTI bulls, the global themes concerning the decline in commodity prices, the slowdown in Asia and continual concerns over the pace of growth in Europe and Japan have not changed. Any elevated concerns over the global economy may lead to fears that there will be less demand for oil, which could act as a major catalyst to quell any upside momentum.

Economic data released in early October from the United States offers a valid reason for the Fed to hold off a US rate hike until 2016. Dollar weakness continues to be the theme that runs the global currency markets. Anxious market participants have reduced their bets on a 2015 US rate hike, which has exposed the USD to vulnerability throughout the currency markets. With sentiment turning bearish on the Dollar, the USD index may decline to the next relevant support based at 94.00.

It seems that the increasing speculation that further monetary stimulus is on the way from China has led equity markets higher at the beginning of the week. Although the China markets are closed for the week-long national day holiday, speculation is mounting that the PBoC are about to unleash further stimulus, and this could result in a sharp bounce when the Shanghai Composite Index reopens. While the global equity markets suffered throughout the previous quarter, they have begun the final quarter far more positively and are currently recording strong gains.

USDZAR

The USDZAR remains technically bearish on the daily timeframe as long as prices can keep below the 14.050 resistance. Prices are trading below the 20 Daily SMA and the MACD has crossed to the downside. The next relevant support is based at 13.200.

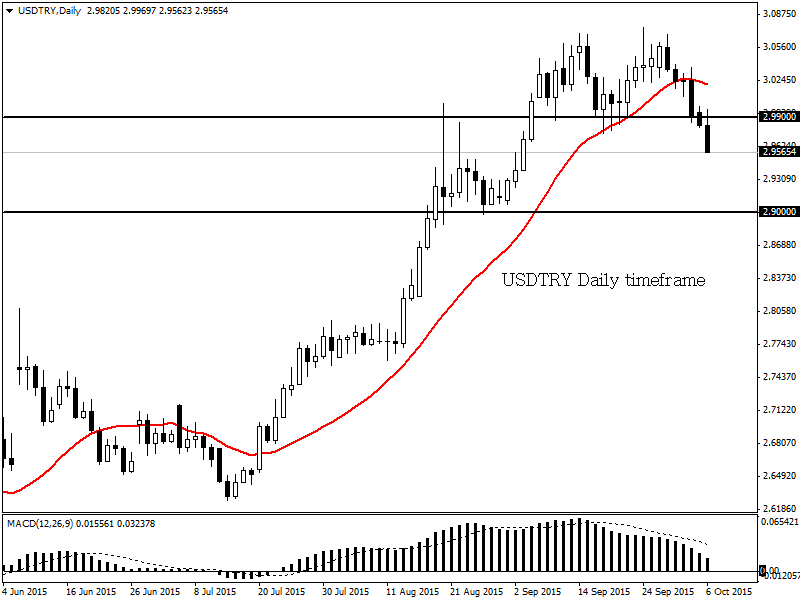

USDTRY

The USDTRY is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD is in the process of crossing to the downside. Previous support at 2.990 may become dynamic resistance which should aid a move to the next relevant support based at 2.900.

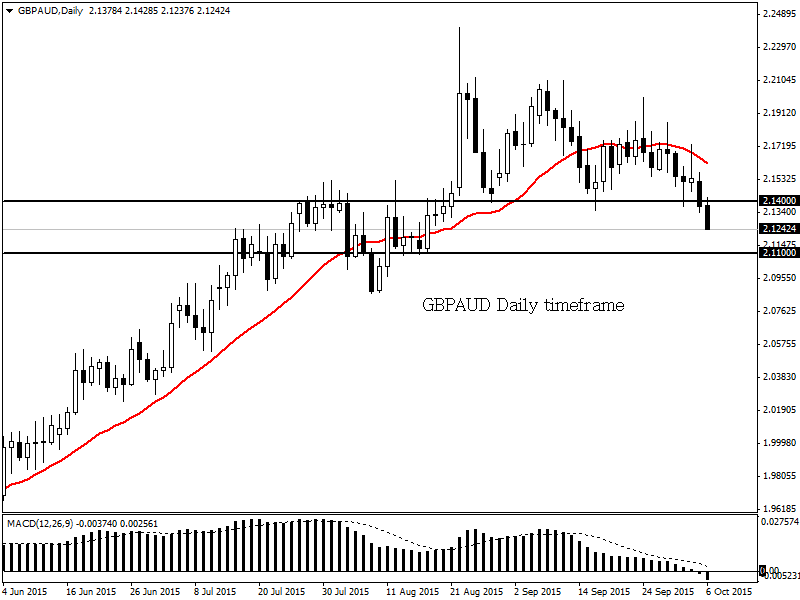

GBPAUD

This pair remains technically bearish on the daily timeframe. Prices have breached the 2.1400 support with the next relevant support based at 2.1100. Prices are trading below the 20 SMA and the MACD has crossed to the downside.

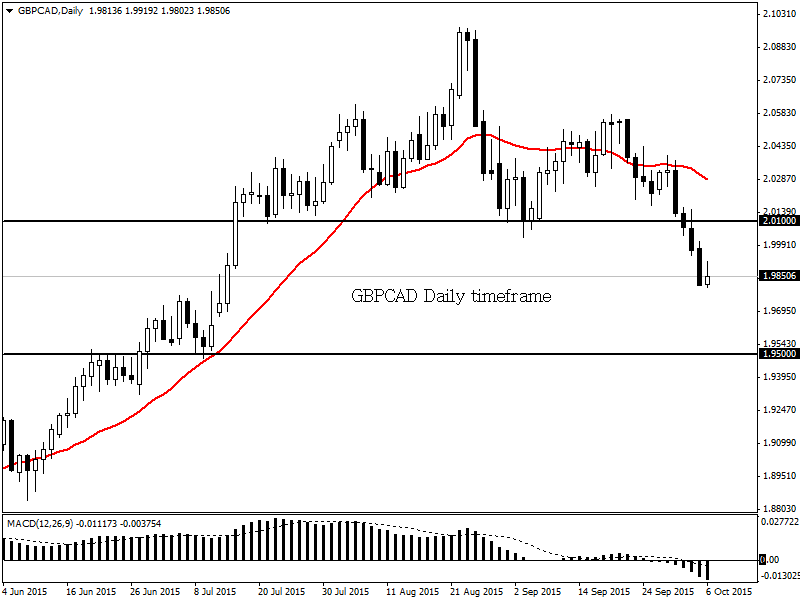

GBPCAD

The GBPCAD remains technically bearish on the daily timeframe as long as prices can keep below the 2.0100 level. The next relevant support is based at 1.9500. Prices are trading below the 20 Daily SMA and the MACD has crossed to the downside.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.