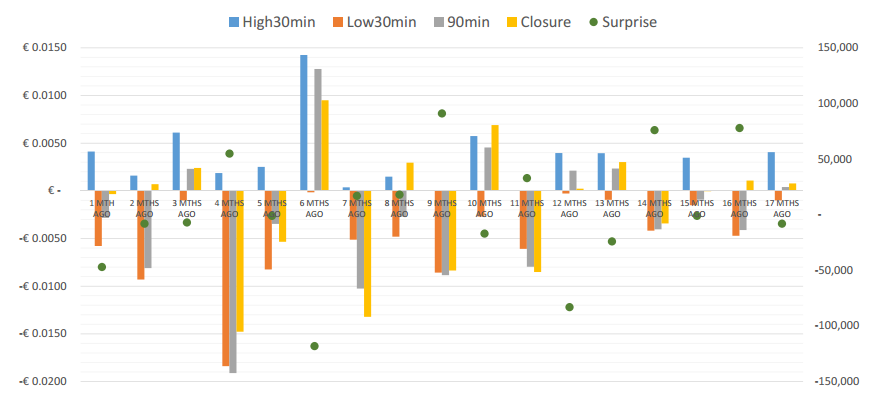

Four graphs illustrating EURUSD impact from NFP releases

Graph 1 sets out the surprise element and impact as seen over the first 30 minutes, after 90 minutes and by the end of the day on an axis from last month all the way up until 17 months ago.Graph 1: The last 17 releases of US Non-Farm Payrolls

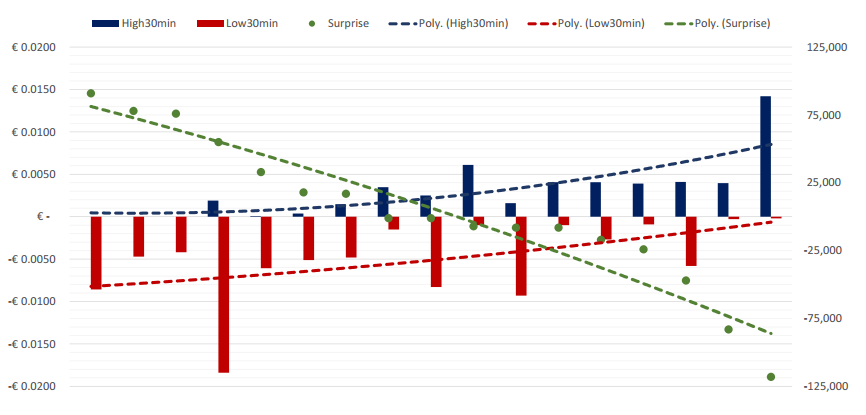

Graph 2 sets out the surprise element and EURUSD impact over the first 30 minutes – both as High and Low – in pips terms from the EURUSD price at the time of NFP release. The data are sorted from the most positive to the most negative surprise element.

Graph 2: The last 17 releases of US Non-Farm Payrolls The 30 minutes Picture

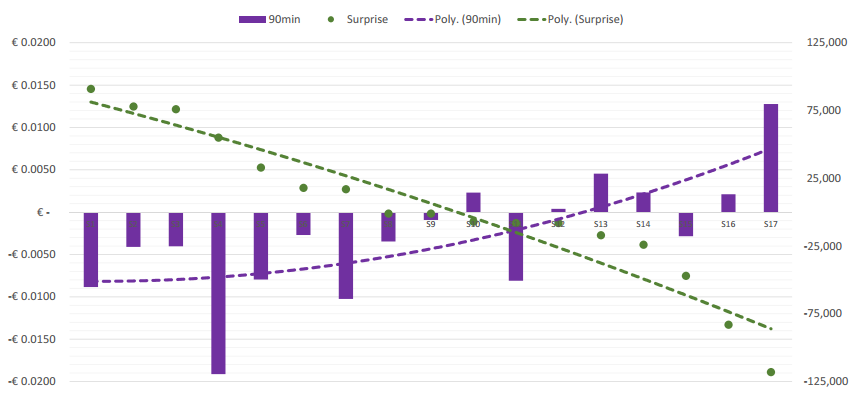

Graph 3 sets out the surprise element and EURUSD impact over the first 90 minutes – as a net move – in pips terms from the EURUSD price at the time of NFP release. The data are sorted from the most positive to the most negative surprise element.

Graph 3: The last 17 releases of US Non-Farm Payrolls The 90 minutes Picture

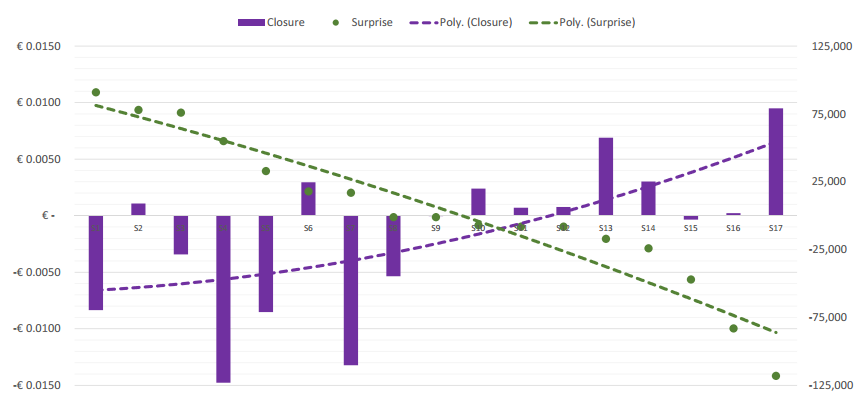

Graph 4 sets out the surprise element and EURUSD impact by the end of the day – as a net move – in pips terms from the EURUSD price at the time of NFP release. The data are sorted from the most positive to the most negative surprise element.

Graph 4: The last 17 releases of US Non-Farm Payrolls The End of Day Picture

Surprise is defined as the difference between the Actual release and Consensus Estimate.

Trading US Non-Farm Payrolls

From the last 17 observations there were 10 releases with a negative surprise element and 7 releases with a negative surprise element. The surprise element were generally bigger for positive surprises than those being negative.The overall picture illustrate what one would expect – that a positive surprise element is EURUSD negative and a negative surprise element is EURUSD positive.

What the observations also show is that the EURUSD impact to the downside was bigger from a positive surprise element than the EURUSD impact to the upside from a negative surprise element. I would not necessarily put too much weight to this conclusion as it is only based on 17 observation. But it might be related to that the positive surprise elements were substantially bigger than those being negative.

There is rather little to gain from trading the NFP release after the first 30 minutes as the net impact as per 90 minutes tend not to be an extension of the High or Low seen over the first 30 minutes.

These 17 observations also show that there is little to gain from trading or holding on to EURUSD positions entered into upon release and until the end of the day, as these observations show that the price tend to correct a bit from the High or Low seen over the first 30 minutes.

That having been said – by extending the number of observations to our full data base (going back to the start of 2010), there are releases throughout that period where the EURUSD impact seen at the end of the day has been wider than that seen over the first 30 minutes. As such - the release had a sustainable impact on EURUSD. This was particularly the case during the period when a series of disappointing NFP releases were replaced with a series of positive releases.

As there are more employment data released at the same time, those can also influence the observations for EURUSD impact.

Order books in banks and/or the initial reaction to NFP being muted from or corrected by the other data, could mean that EURUSD might fluctuate both above and below the release price for some time before finding a direction. In general I would say that should such volatility provide a EUIRUSD price higher than the release price on a positive surprise element, you sell the EURUSD and equally should such volatility give a EURUSD price below the release price on a disappointing surprise element, you buy EURUSD. You might argue that such price levels should not be possible to obtain on a clear surprise element. You would be surprised how many times it happens.

In general – from these observations – the NFP release is one event for which you enter and exit trades within the first 30 minutes.

Trading US Non-Farm Payrolls October 2nd, 2015

Should one not be exposed in advance of a NFP release, it is a matter of getting in early on the move after release. I measure this in pips terms and not in time.Over the first 30 minutes I do as follows:

1. Should the surprise element be < +/- 25K, I seldom do anything as I would expect EURUSD not to move more than 40 pips. It might do but the number of observations in our research material tell me that this is not with a high enough probability.

2. Should the surprise element be +/- 25K to +/- 50K, I would want to enter within the first 25 pips of the move and exit for 40-70 pips.

3. Should the surprise element be +/- 50K to +/- 100K, I would want to enter within the first 30 pips of the move and exit for 70-100 pips.

4. Should the surprise element be more than + 100K, then I likely trade as under 3) as I see parts of the figure to be a correction to the month before. Should – on the other hand – the surprise element be more than 100K down, then the whole question about USD interest rate increases this year is up for question. We could get more of massive USD long positions being unfolded and the impact on EURUSD could be much more. I would then likely reflect a couple of seconds, try to get in within the first 35-40 pips of the move and sit with this position for a wider impact over sessions to come.

While all material on this website are our own thoughts, ideas and opinion, neither of those - including the trading strategies - are recommendations for others to follow. We do not provide advisory services, we simply analyses economic data and price actions for a set of currency pairs and tell users of the platform what our findings are and what conclusions we draw from them for ourselves. In doing so - and - user of this website have their own risk parameters and criteria they follow, we are not responsible in any way for losses that might occur from thoughts or ideas expressed on this website.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.