It is a battle between giants but not one which is going to cause a lot of volatility as long as they keep their formations and are broadly balanced in size of what they do. The volatility you get should one of them turn ignorant or be neutralized.

This is how I see it:

There are two balance of payment components that are interesting to follow in terms of currencies and the influence they have on a country’s own currency – the current account and net investment flows.

The broader part of a current account is normally the trade balance – the difference between export of goods and services and imports of goods and services. Should a country have a trade balance surplus so is normally also the case for their current account balance. That export exceeds import also means that there is more demand for a country’s currency than demand for other currencies.

Countries with current account surpluses over long time tend to see an appreciation of their currencies while countries with current account deficits over longer periods tend to see their currencies depreciating in value. The bigger the discrepancies are and the longer they last, the bigger are their impact on the value of currencies.

Net inflow of capital means that foreign investors buy more of a country’s currency than domestic investors’ need of other currencies for their investments abroad. Net inflow of capital to a country has an appreciating effect on that currency while net outflow of capital from a country has the opposite effect.

Markets tend to ignore the importance of these balance of payment components. I don’t know why but likely it is from the historical fact that countries over too long periods either have foreign surpluses or foreign deficits for many years. The time factor – likely adds to the ignorance element. I mean who in the market today has ever experienced the US having anything but current account deficits. When you have seen nothing else you also likely tend to ignore that this is a problem for the USD. I mean the USD goes up and down anyway. That the deficits has a permanent negative impact on the USD is easy to forget.

A second reason is likely that the volatility impact on a currency is limited from these surpluses or deficits. They derive from corporate transactions or flows that takes place regularly – I would say all the time – from smaller import bills to be paid to more substantial capital transactions. As a market player you don’t see them and for that reason you likely also tend to ignore them.

The US trade balance we get as monthly data releases to markets while the current account balance is publicized on a quarterly basis. The monthly deficits have for the trade balance been in the area of 35 billion $ while the current accounts have been stable around – 40 billion $. While these are big numbers, relative to the size of the US economy – they are small which reflects that the US economy is more based on domestic demand than international trade.

The Euro area is much more of an open economy where import and export amount to a big part of the overall economy. The biggest economy – Germany – has had trade balance and current account surpluses over numerous years. Their export activity is very competitive both in terms of brand names and technology – making the activity less price sensitive also from the impact of fluctuating euro values.

For other Euro area countries the situation is different – especially for those in the south. They have much more of classic export activities – less sophisticated in terms of technology and much more price sensitive also from the impact of fluctuating euro values.

Despite so – there has been a noticeable change over the last three years. Until recently these countries showed trade and current account surpluses – something we had not seen for most of them throughout many years. And it was only very recently when the euro took on a level higher than seen for a long time that you saw a negative impact on their foreign balances.

Their improved competitiveness one can explain in their unit labour cost. They simply produced more for the same employment cost. This so-called “internal devaluation” was a consequence of much needed structural changes at the cost of employment and employment conditions.

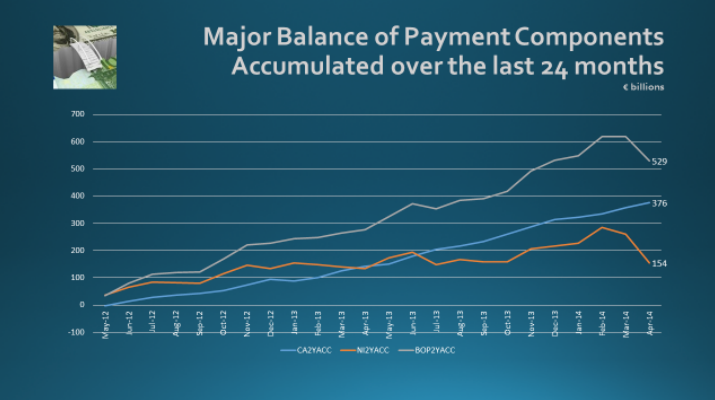

We do not talk about small figures. On average over the last two years, the Euro area has shown more than 15 billion euros of monthly surpluses on their current account balance – almost 20 billion euros if we limit the historical material to the last 12 months.

The other important part of the balance of payment components are net inflow or outflow of investments. For the Euro area we have also seen net inflow of capital over the last two years – amounting to a total of 160 billion euros. These investments are from long term investors either in equities or fixed income markets – the most noticeable being sovereign wealth funds and other reserve fund portfolios.

Totally – current account surpluses and net investment inflow have amounted to 530 billion euros over the last 24 months. In reality it has meant that the two sectors: corporates and long term investors have bought net 530 billion euros.

When someone goes long in a currency, others go short. Not everyone can be long or short. When corporates and long term investors have bought net 530 billion euros over the last two years, other market participants have sold the same amount.

Who are the others? One participant could have been the ECB selling euros to meet the demand from the real economy. They have not – in terms of currency interventions, they have stayed side lined over the last 24 months.

Excluding the ECB we are left with only one group of participants that could have provided the euros to corporates and long term investors: I call them the speculative part of the market. They could be banks, traders, hedge funds – all those who normally have a shorter horizon for what they are doing, take profit from rather moderate objectives and put stops to whatever they are doing. They are the ones that has supplied the 530 billion euros which corporates and long term investors net have bought.

Whether or not they are 530 billion euros short or not I don’t know. For all I know they could have been long going more than two years back. I doubt it though but regardless – they have sold 530 billion euros net to corporates and long term investors.

I therefore conclude that the short term, speculative part of the market is heavily short in euros. I further conclude that it will be difficult for the ECB to obtain a lower euro for as long as short positions among speculators are as substantial as I think they are.

I don’t think negative deposit rates offered to banks by the ECB nor the later coming TLTROs are going to change anything in this respect.

You might get some money market funds to sell euros from the low interest rate scenario seen. That would be helpful as it would reduce the short positions among speculators. But the “if” in this respect is substantial as we have no precedence or historical data we could use as predictions in terms of impact from negative deposit rates.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.