The gold could be underpinned for another day ahead of the FOMC meeting outcome today which is expected show increasing worries about the global economic slowdown to hint holding of the interest rate with no hike in the first quarter of this year, while the doubts about the US manufacturing sector ability to expand this harsh winter are rising.

Yesterday auction of UST 2YR issuance could highlight this current lower prospects of watching higher interest rate in US, as it ended to 0.86% yield, after ending the previous auction on it on 1.056% yield on last Dec. 28 following last FOMC meeting when the Fed decided to raise its funds rate by 0.25% expecting reaching 1.375% at the end of 2016.

The gold could keep its bullish tone this week to be traded now above $1120 for the first time since last Nov. 4, despite the improving of US equities market amid oil prices rebound, upbeating Q4 earning reports and higher than expected US consumer confidence in January reached 98.1, while the consensus was referring to 96.6 after 96.3 in December.

The Asian equities indexes could follow their US counterparts, after being exposed to massive falling yesterday with the oil benchmarks retreating from $32.80 area to be traded again below 30$.

Instrument in Focus: AUDUSD

AUD could be boosted during the Asian session, after the release of higher than expected inflation figures in the fourth quarter of last year. CPI Q4 rose yearly by 1.7%, while the market was waiting for 1.6%, after 1.5% in the third quarter showing lower probability of having further stimulating measurements by RBA which has kept the interest rate unchanged at 2% since last May. 5.

AUDUSD is now trading near 0.7030, after rebounding from 0.6916 whereas it has formed higher low above its bottom of this Jan. 15 at 0.6825.

AUDUSD is still facing difficulty to get over 0.7046 which set it back twice this month AUDUSD daily Parabolic SAR (step 0.02, maximum 0.2) is now its fifth day of being below the trading rate reading today 0.6851.

AUDUSD daily RSI-14 is referring now to existence in its neutral area reading now 48.390 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having its main line now in the neutral region but close to the overbought area above 80 reading now 75.755 and also its signal line which is referring to 74.834

Important levels: Daily SMA50 @ 0.7148, Daily SMA100 @ 0.7146 and Daily SMA200 @ 0.7349

S&R:

S1: 0.6916

S2: 0.6825

S3: 0.6769

R1: 0.7046

R2: 0.7084

R3: 0.7120

AUDUSD Daily Chart:

Commodities: Gold

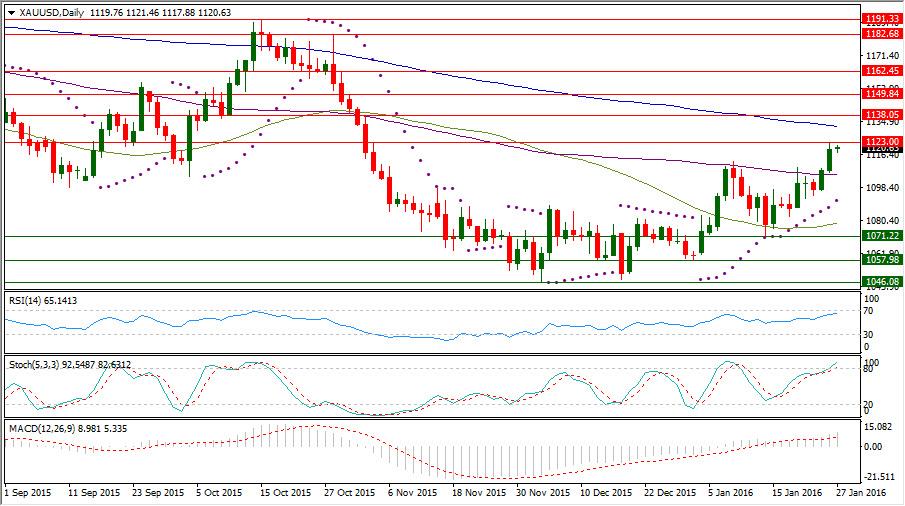

The gold could find more demand, after getting over its daily SMA100 following surpassing $1112.75 which has been its highest reached level since last Nov. 4.

The gold could gather momentum, after holding above $1071.22 which could help the gold to bounce up again above its daily SMA50 forming a floor above $1057.98 which drove the gold to start being above its daily Parabolic SAR (step 0.02, maximum 0.2) for 18 consecutive days reading today $1091.15.

XAUUSD daily RSI-14 is referring now to existence in its neutral area reading now 65.141, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility could have now its main line in the overbought area above 80 reading 92.548 leading to the upside its signal line which is now also in the overbought area reading 82.631.

Important levels: Daily SMA50 @ $1078.54, Daily SMA100 @ $1105.67 and Daily SMA200 @ $1132.27

S&R:

S1: $1071.22

S2: $1057.98

S3: $1046.08

R1: $1123

R2: $1138.05

R3: $1149.84

XAUUSD Daily chart:

Hot instrument: USDCAD

The oil benchmarks could lead the movement of USDCAD to watch it forming lower high at 1.4323 with WTI having higher low near $29.25.

CAD has been exposed to massive selling across the broad in the beginning weeks of this year tracking the oil prices slide which can erode the Canadian exports value causing financial pressure on the Canadian economy.

On the oil prices slide, BOC has revised down its 2016 GDP forecast to only 1.4% from 2% last week but it decided to disappoint the odds of watching another interest rate cutting by keeping the interest rate unchanged at 0.5% driving USDCAD down below 1.45 to start having its daily Parabolic SAR (step 0.02, maximum 0.2) above the trading rate and today is the day number 5 of continued being above the trading rate reading 1.4606.

USDCAD daily RSI-14 is in the middle of the neutral territory reading 50.359, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the oversold area below 20 area reading 19.320 and also its signal line which is reading now 15.811.

Important levels: Daily SMA50 @ 1.3837, Daily SMA100 @ 1.3506 and Daily SMA200 @ 1.3074

S&R:

S1: 1.4042

S2: 1.3895

S3: 1.3811

R1: 1.4323

R2: 1.4687

R3: 1.4946

USDCAD Daily chart:

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.