With the oil benchmarks retreating to $30 per barrel, The major equities indexes have been exposed to increasing downside pressure by the end of the US session to affect negatively on the Asian session which watched sell-off in the beginning of it.

WTI and Brent have been halted in the beginning of yesterday European session by facing resistance area at $32.80 whereas they have started to recede again.

The market focusing is expected to be next on the Fed which is expected to send dovish messages about the global economic slowdown to hint holding rate with no hike in the first quarter of this year, after the financial market turmoil, while the worries about the US manufacturing ability to expand further are rising in this harsh winter From another side, The Japanese economy Minister Amari refrained from giving answers about the next BOJ's step indicating that Kuroda will do the appropriate step in the suitable time adding that he does not think that BOJ will follow the ECB by sending hinting messages, before taking new step.

While PBOC is looking caring meanwhile of the capital outflows which are threatening the Chinese decelerating economy. So, it is not expected soon to take new easing steps can lower the value of the Yuan further, while it is supporting its offshore exchange rate currently.

Instrument in Focus: GBPUSD

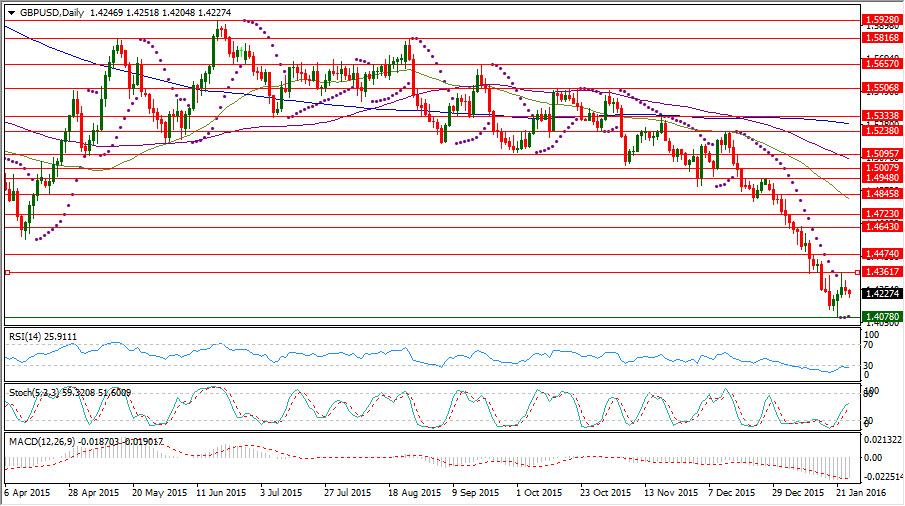

After rebounding from 1.4078 to 1.4361, The cable came again under pressure to retreat for trading currently near 1.4225.

The cable rebound made its daily Parabolic SAR (step 0.02, maximum 0.2) below the trading rate for the third consecutive day reading today 1.4084.

The cable daily RSI-14 is still into its oversold area below 30 reading now 25.911, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in neutral region reading 59.320 and also its signal line which is reading now 51.600, after a shy try to fix its oversold stance has been limited by reaching 1.4361.

Important levels: Daily SMA50 @ 1.4814, Daily SMA100 @ 1.5065 and Daily SMA200 @ 1.5285

S&R:

S1: 1.4078

S2: 1.40

S3: 1.3844

R1: 1.4361

R2: 1.4474

R3: 1.4643

GBPUSD Daily Chart:

Commodities: CL Mar. 16

CL Mar. 16 started to retreat again, after reaching $32.73 yesterday following the first considerable try to fix its oversold stance which placed the mixture daily Parabolic SAR (step 0.02, maximum 0.2) below the trading rate yesterday before reading today 27.65 in its second day of being below the trading rate.

CL Mar. 16 daily RSI-14 is referring now to existence in its neutral area reading now 36.254 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having its main line now in the neutral region reading 59.736 close to its signal line which is referring to 59.046, after the rebound abated without having a chance to get over its Daily SMA20 forming yesterday long dark day to contain last Friday long white day.

Important levels: Daily SMA20 @ $32.89, Daily SMA50 @ $36.78, Daily SMA100 @ $41.23 and Daily SMA200 @ $47.40.

S&R:

S1: $27.55

S2: $26.93

S3: $25.25

R1: $32.73

R2: $33.35

R3: $35.57

CL Mar. 16 Daily chart:

Hot instrument: Gold

The risk-off sentiment could add attractiveness to the gold today to surpass $1112.75 which has been its highest reached level since last Nov. 4.

The gold which is boosted too by the odds of delaying the next Fed's tightening step is now well above its daily SMA100.

The demand for safe haven could drive the gold up previously in the beginning week of the year to reach $1112.75 but it failed to maintain a place above its daily SMA100 to retreat to $1071.22 which supported the gold again keeping the existence above its daily SMA50 and also above its daily Parabolic SAR (step 0.02, maximum 0.2) for 17 consecutive days reading today $1087.65.

XAUUSD daily RSI-14 is referring now to existence in its neutral area reading now 62.072, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line barely in the overbought area above 80 reading now 80.619 and leading to the upside its signal line which is reading now 75.037.

Important levels: Daily SMA50 @ $1077.62, Daily SMA100 @ $1105.57 and Daily SMA200 @ $1132.61

S&R:

S1: $1071.22

S2: $1057.98

S3: $1046.08

R1: $1123

R2: $1138.05

R3: $1149.84

XAUUSD Daily chart:

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.