Following the oil prices again, The US major stocks indexes could rebound by the end of yesterday session but they could not close in the green territory, while Brent could return for trading near $28.20 per barrels, after holding barely above $27.

SP-MAR16 has formed a dark hammer candle yesterday, before extending its rebound during today Asian session to be near 1870 containing all of yesterday massive falling to 1804.25.

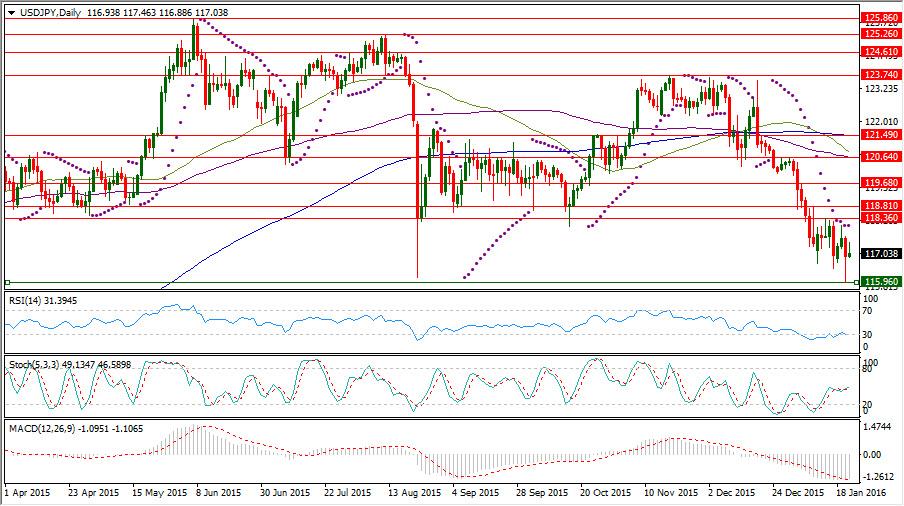

USDJPY has reflected this improvement of the risk appetite by bouncing up from 115.96 for trading currently near 117.30 containing most of yesterday losses. While the cable could have finally yesterday a green daily candle to be trading near 1.4175 supported by the bullish release of Dec UK labor report.

The report has shown that UK ILO unemployment rate which counts the number of unemployed workers divided by the total civilian labor force has retreated to 5.1% in the 3 months to November, while the market was waiting for 5.2% as the same as the 3 months to October with falling of the jobless claimant change which counts the number of people claiming unemployment related benefits every month by 4.3k, while the consensus was increasing by 2.5k, after falling in November by 2.2k.

Instrument in Focus: USDCAD

CAD has tracked the oil benchmarks rebound, after it had been exposed to massive selling across the broad because of the aggressive oil falling which can erode the Canadian exports value causing financial pressure on the Canadian economy.

BOC has revised down its 2016 GDP forecast to only 1.4% from 2%, after stalled economic growth in the last quarter of last year.

But it has decided to keep the interest rate unchanged at 0.5% yesterday driving USDCAD down below 1.45 by disappointing the odds of watching another interest rate cutting.

Despite the retreating from 1.4687 to 1.4447, USDCAD is still above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.4394 in its day number 13 of continued being below the trading rate.

USDCAD daily RSI-14 is still into the overbought area above 70 reading 76.998, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral region coming down from its overbought area above 80 reading 63.129 and also its signal line which is reading now 78.322.

Important levels: Daily SMA50 @ 1.3774, Daily SMA100 @ 1.3473 and Daily SMA200 @ 1.3037

S&R:

S1: 1.4429

S2: 1.4174

S3: 1.4048

R1: 1.4687

R2: 1.4946

R3: 1.50

USDCAD Daily Chart:

Commodities: Gold

The risk-off sentiment helped the gold to extend its rebound from $1071.22 per ounce to reach yesterday $1109.36 per ounce spiking above its daily SMA100, before residing for trading below it now near $1100 per ounce.

The demand for safe haven could drive the gold up in the beginning week of the year to reach $1112.75 which has been its highest reached level since last Nov. 4 but it retreated again failing to maintain a place above its daily SMA100.

Despite the retreating to $1071.22, XAUUSD could maintain existence above its daily SMA50 and it could also have its daily Parabolic SAR (step 0.02, maximum 0.2) below for 14 consecutive days reading today $1080.46.

The gold could rise for trading above this indicator, after having a higher bottom at $1057.98 following maintaining existence above $1046.08 by rising from $1047.46 on last Dec. 17.

XAUUSD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral region but it a closer place to its overbought area above 80 reading 72.532 leading its signal line which is reading now 65.490.

Important levels: Daily SMA50 @ $1076.40, Daily SMA100 @ $1116.22 and Daily SMA200 @ $1134.05

S&R:

S1: $1071.22

S2: $1057.98

S3: $1046.08

R1: $1112.95

R2: $1123

R3: $1138.05

XAUUSD Daily chart:

Hot instrument: USDJPY

The risk aversion sentiment could boost demand for the Japanese yen, as this low cost financing currency usually gains benefits during the dovish market sentiment.

The Japanese yen could also gain benefits recently from the Chinese Yuan suffering, as an Asian competitive reserve currency, while there is no signal yet from BOJ to take further easing steps.

USDJPY has been exposed to increasing downside momentum to reach 115.96 surpassing last Aug. 24 low at 116.15, before rebounding to 117.46 during today Asian session.

But this containing cannot be reliable to go further to the upside without bringing down 118.36 which could hold in the face of the pair tries to rise in the recent 9 days to be exposed to forming lower highs below it.

USDJPY daily Parabolic SAR (step 0.02, maximum 0.2) is reading 118.10 in its day number 20 of consecutive being above the trading rate.

While USDJPY daily RSI is referring now to existence barely in the neutral region coming from its oversold area below 30 reading now 31.394 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility could have its main line in the neutral region reading now 49.134 and also its signal line is reading now 46.589.

Important levels: Daily SMA50 @ 120.84, Daily SMA100 @ 120.65 and Daily SMA200 @ 121.48

S&R:

S1: 115.96

S2: 115.55

S3: 114.87

R1: 118.36

R2: 118.81

R3: 119.68

USDJPY Daily chart:

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.