Shanghai composite returned today to the red territory trading below 3000, after rebounding of the risk appetite by the end of yesterday session could be extended into the US session with oil benchmarks ability to rise from their new 12 years low levels below $30 which have been recorded this week.

US Import Price Index of December has fallen by 6.5% y/y, after 6.3% decreasing in November and also US Export Price Index came down by 8.2%, after declining by 9.3% in November because of the greenback appreciation amid oil prices weakness and also retreating of commodities prices showing low pressure on the Fed to raise rates for containing the inflation.

From the other side of the Atlantic, BOE expected yesterday inflation rising by a gradual pace, after unusual large drags from energy and food prices, while the core inflation pressure remains relatively subdued.

The cable kept trading around 1.4400, after MPC had voted 8:1 for keeping the interest rate unchanged at 0.5%, as it has been since Feb 2009, because Ian Mc Cafferty is still considering hiking the interest rate by 0.25% to 0.75%, before watching inflation building pressure by the wages rising, British pound depreciation and domestic costs, as long as there is conviction among the members that the pace of tightening will be gradually.

MPC voted unanimously to hold BOE’s APF at Stg375b, as it has been since July 2012 re-investing the £8.4 billion of cash flows associated with the redemption of the January 2016 gilt held in the Asset Purchase Facility.

Instrument in Focus: GBPUSD

The cable could rebound from 1.4350 keeping June 2010 supporting level at 1.4345 unbroken until now but this try to rise again could not get the cable daily RSI out of its oversold area below 30 reading now 21.795.

While its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line barely in the neutral region coming up from its oversold area below 20 reading 20.023 and also its signal line which is reading now 22.017, after a shy try to correct some of its oversold stance has been faced by resistance at 1.4474, before residing for trading currently near 1.44 in its day number 22 of continued being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.4527.

Important levels: Daily SMA50 @ 1.4950, Daily SMA100 @ 1.5141 and Daily SMA200 @ 1.5308

S&R:

S1: 1.4345

S2: 1.4257

S3: 1.4228

R1: 1.4474

R2: 1.4643

R3: 1.4723

GBPUSD Daily Chart:

Commodities: Gold

The risk-on sentiment could come back to the markets putting pressure on the gold to retreat yesterday to $1071.22 level, before residing for trading now near $1080 per ounce just above its daily SMA50.

The demand for safe haven could drive the gold up reach by the end of last week $1112.75 which has been its highest reached level since last Nov. 4 but it retreated again failing to maintain a place above its daily SMA100.

Despite yesterday retreating to $1071.22, XAUUSD daily Parabolic SAR (step 0.02, maximum 0.2) is still below its trading rate for the tenth consecutive day reading now $1071.22 too. The gold could rise for trading above this indicator, after having a higher bottom at $1057.98 following maintaining existence above $1046.08 by rising from $1047.46 on last Dec. 17.

Important levels: Daily SMA50 @ $1079.17, Daily SMA100 @ $1107.69 and Daily SMA200 @ $1136.08

S&R:

S1: $1071.22

S2: $1057.98

S3: $1046.08

R1: $1112.95

R2: $1123

R3: $1138.05

XAUUSD Daily chart:

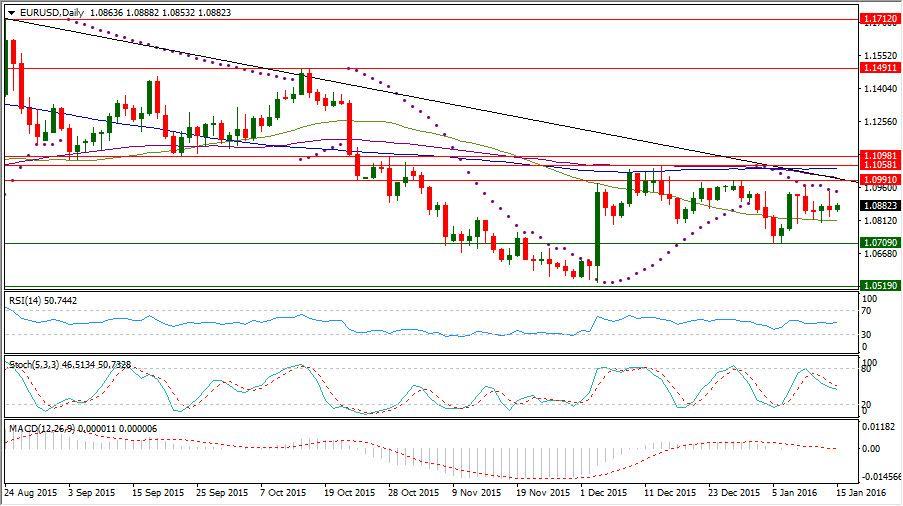

Hot instrument: EURUSD

EURUSD has spent most of this week trading times close to 1.0880, after finding support at 1.0709 following retreating from 1.0968.

The pair is still keeping a place for trading above its daily SMA50 but with continued existence below its daily SMA100 and daily MA200.

The pair is still trading below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.0941 in its eleventh consecutive day of being above the trading rate with continued existence below the trendline resistance extension from 1.3992 to 1.1712.

While the pair parameters are showing now balanced situation having its daily RSI in the middle of the neutral reading 50.744 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral region reading 46.513 with its signal line which is reading 50.732.

Important levels: Daily MA50 @ 1.0814, Daily MA100 @ 1.1006 and Daily MA200 @ 1.1047

S&R:

S1: 1.0709

S2: 1.0519

S3: 1.0461

R1: 1.0991

R2: 1.1058

R3: 1.1093

EURUSD Daily chart:

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.