The first Asian session of the week has shown that shanghai composite index returned to dominate the sentiment by its losses, after dovish closing of the US major stocks indexes last week.

As the bullish US Labor report of December could not prevent the US blue chips to have another dovish closing, despite opening last Friday trading in the green territory.

The report could not raise the trust in the financial markets but it could restore confidence in the US economy ability to produce more jobs by a stronger pace, despite the achievements which have already been done in the labor market in the recent years and also despite the manufacturing performance slowdown which has happened by the end of last year with stronger dollar eroding of the US products competitivity.

The report has shown adding 292k of jobs out of the farming sector while the market was waiting for adding only 200k with upward revision of October adding from 298k to 307k and also for November adding of 211k to 252k.

But the weak point in this report was the inflation wage pressure which has been tame in December by no monthly change, while the consensus was referring to increasing by 0.25 as the same as November.

Instrument in Focus: USDJPY

USDJPY could have the most volatile reaction to the US labor report on its sensitivity to the risk appetite.

After the release of Dec US labor report, USDJPY spiked to 118.81 to form another lower high to fall from again and with the beginning of the new week in has made another lower low at 116.67 below 117.30 which could stop it by the end of last week.

USDJPY has opened the new week on a downside gap at 117.14, before extending its losses to 116.67 whereas it could bounce up to fill this gap trading again close to 117.30.

USDJPY daily RSI is referring to existence in its oversold area below 30 reading now 21.402 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in its oversold area below 20 reading 12.061 and also its signal line which is reading now 10.594, despite the rebounding from 116.67 to correct some of its oversold stance.

USDJPY is now in deeper place below its daily SMA 50, daily SMA100 and daily SMA 200 and its daily Parabolic SAR (step 0.02, maximum 0.2) is reading 120.68 in its day number 12 of consecutive being above the trading rate to reflect accumulating of the downside pressure on this pair.

Important levels: Daily SMA50 @ 121.59, Daily SMA100 @ 120.88 and Daily SMA200 @ 121.57

S&R:

S1: 116.67

S2: 116.15

S3: 115.55

R1: 119.68

R2: 120.64

R3: 121.49

USDJPY Daily Chart:

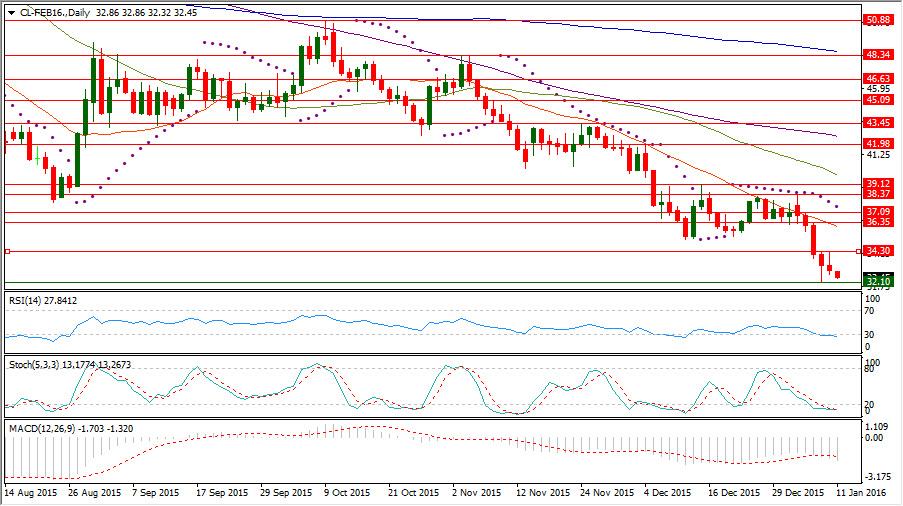

Commodities: CL Feb. 16

CL FEB 16 rebound from last Wednesday low at $32.10 ended until now to reaching a new lower high at $34.30 to fall from for trading currently close to $32.50 unfazed of the falling of US EIA Oil stockpile of the week ending on Jan. 1 by 5.085, while the market was waiting for decreasing by only 0.5m.

After last week bullish opening on rising tension between Iran and Saudi Arabia, CL FEB 16 spiked up to $38.37, before coming again under increasing selling pressure because of doubts about the Chinese economic activity and the weaker than expected US manufacturing performance by the end of last year which could dominate the market sentiment hurting the demand expectations for oil.

CL FEB 16 daily RSI is referring to existence in its oversold area below 30 reading now 27.841 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the oversold region below 20 reading now 13.177 and also its signal line which is referring to 13.267.

CL FEB 16 failed to keep a place above its daily SMA20 by falling again from $38.37, while it has been already under downside pressure over longer run by trading well below its daily SMA50, SMA100 and SMA200.

Important levels: Daily SMA20 @ $36.07, Daily SMA50 @ $39.75, Daily SMA100 @ $42.57 and Daily SMA200 @ $48.64.

S&R:

S1: $32.10

S2: $31.28

S3: $30

R1: $34.30

R2: $36.35

R3: $38.37

CL Feb. 16 Daily chart:

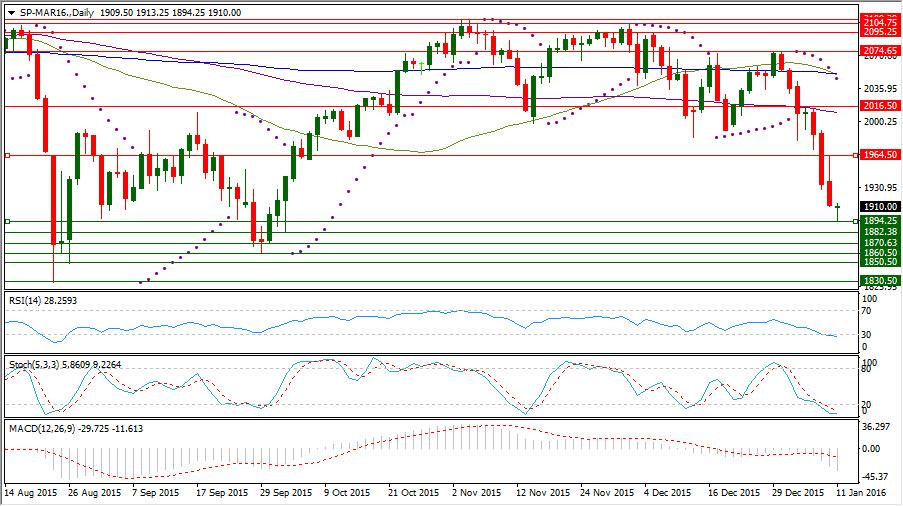

Hot instrument: SP-MAR16

On the bullish release of Dec US labor report, SP-MAR16 could rise but to have only a new lower high at 1964.50 to fall from and in the beginning trading hours of the new week SP-MAR16 future rate came under more pressure to reach 1894.25, before rebounding to 1910 area.

SP-Mar16 has previously formed a lower high at 2074.65 on Dec. 30, after facing difficulty several times to keep a place above 2100 to be exposed to the current downside extension which can lead to forming more lower highs, after failing to return above its daily SMA100 forming resistance at 2016.50.

SP-Mar16 daily RSI is referring to existence in its oversold area below 30 reading now 28.259 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the oversold region below 20 reading 5.860 and also its signal line which is referring to 9.226 showing need for fixing this oversold stance.

Important levels: Daily SMA50 @ 2050.05, Daily SMA100 @ 2009.85 and Daily SMA200 @ 2051.23

S&R:

S1: 1894.25

S2: 1882.38

S3: 1870.63

R1: 1964.50

R2: 2016.50

R3: 2074.65

SP-Mar16 Daily chart:

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.