EURGBP - weekly 200MA

The EURGBP inverse Head and Shoulders has not quite reached its target circled at .8039-65 having been stopped by the weekly 200MA. This maybe the top of the current up move as profit gets taken back towards .7756. Last week's Marabuzo comes in at .7845 and though it has been breached, we are now trading back above it, forthe 200MA to be broken this week Marabuzo needs to hold. Whichever side ofthe 200MA we close this week could give a good clue for trading Cable and EURUSD going forward...

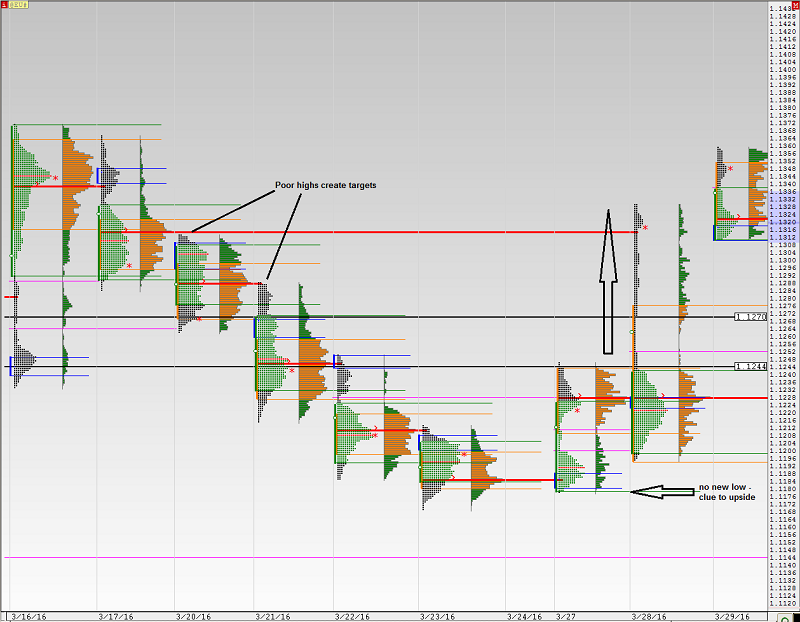

EURUSD dramatic end to 1-time-framing

The surge higher yesterday was definitely aided by Janet Yellen's extremely dovish remarks, however the clues to the move were already in place. Five days of one-time-framing whereby the prior day's high was not taken out whilst the low was, stopped. A new high and value shifting higher early this week, set up a move to target poor (multiple TPO) highs at 1.1288 and 1.1313. With the strong move higher and consolidation today, support is now found at 1.1270 and 1.1244either end of single print vacuum.

Commodity currency strength - AUD

Commodity currencies have surged this week despite modest dips in Oil and Copper. The Aussie found strength from first HVN support .7475 (mentioned in last week’s TNTV) and has moved higher to take the most recent swing high .7680, a close above here today will set the tone for further gains through the congested area (circled) to.7848. Those waiting for a deeper pull back to buy may now be forced to pay higher prices so .7595 old high should provide support. Only a failure below yesterday's low will bring a short term bearish bias.

.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.