Epic Euro Reversal

I don't think you need meto outline quite how epic that reversal was in the Euro yesterday. We obviouslyhad a very similar range back in the December ECB meeting but that was mainlyone way traffic due to everyone being positioned the wrong way heading in. Thisstarted off as a dump but finished as strongly as you could imagine. Thequestion now is what happens now. After December it basically got stuck in atwo and a half point range. It would be perfectly reasonable to have a littleconsolidation over the next week but I would expect a retest of the recenthighs towards 1.14 soon. 1.1060-90 is key support below which I'd want to holdif this isn't to be just an epic short squeeze. Any sustained move above 1.14targets 1.1485 initially. After here resistance lies at 1.16 and 1.1720.

Cable remainsbullish, for now

Cable had a similarreversal pattern to the Euro yesterday if not with the same magnitude. It couldstill mark an important day though it essentially tested the recent support andbounced, with a close above all the recent highs. For now this pair is shortterm bullish. In the medium term I did suggest last week that so long as wedon't close back above the TL (which also ties in withe 61.8%) then sellingrallies would still be the play. That has changed somewhat with yesterdaysprice action but a reaction around this key area will still be important forwhere we go over the next few weeks so keep an eye out.

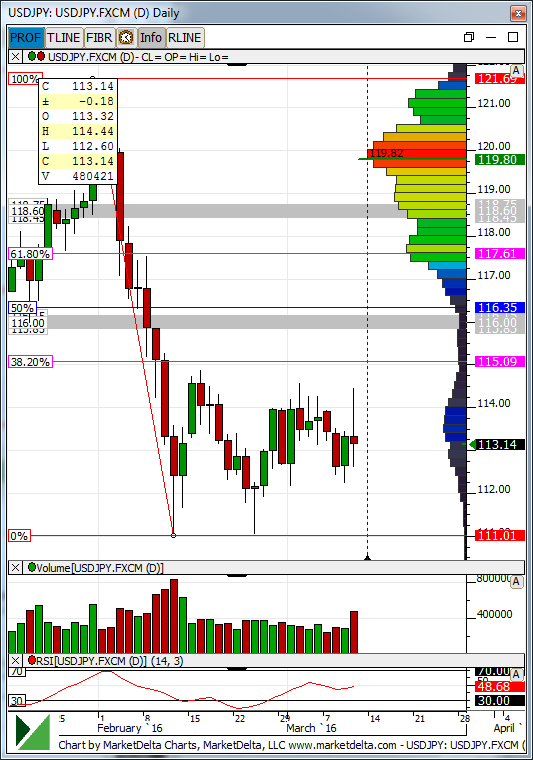

Dollar Yen stillflagging

Feels like I'm writing thisevery week but we're still essentially in a daily bear flag in the Dollar Yen.it is getting a little long in the tooth at the moment though and we'd wantthis to resolve itself one way or another pretty quickly. Was yesterday'scandle a clue? It was a pretty big reversal so any follow through should in theorysee a break of the flag which of course has a sizable 10 handle target. I'mnot sure we'll go there in a straight line but a break of the double bottom iscertainly to be expected. 115.00 is the obvious key area above and if we getback through here shorts are not the right play..

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.