Aussie - keyresistance broken

With Australia being amajor commodity exporter, the recent surge in commodity prices has had theobvious impact of strengthening the AUD and taking it beyond key resistance at.7385 which had capped the top of the range for the last 6 months. Until a closeback below .7386 is seen the next target will be the band .7530-95. The currentcommodity rally has come very suddenly and may be getting a bit overdone if itdoes take a breather and pull back look for support to be found at 200MA andcluster of highs, circled, around .7259-43 as weak longs get squeezed below thekey level.

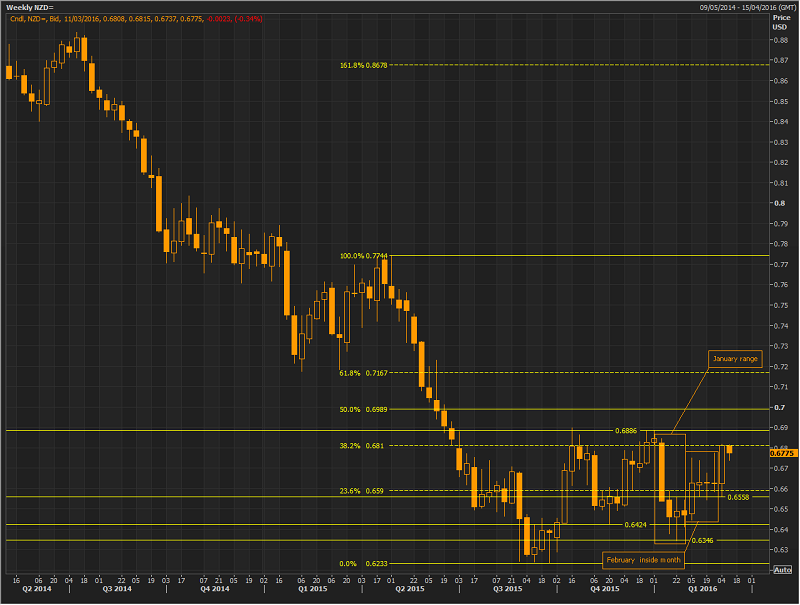

NZD - inside monthbreak ahead of rates

Later today we get thelatest interest rate decision out of the RBNZ, unchanged is expected howeversome analysts are looking for a 0.25% cut to 2.25%. Looking to thetechnicals; last week saw a break and close outside of inside monthabove .6774, so far this week we have tested back down and rejected. The rate decisionmay help NZD higher if it is unchanged and target the top of recent range at.6886-97, however the surprise cut will likely cause a failed inside monthbreak and move back towards .6558 and February lows .6447

Draghi hinted strongly at the last ECB meeting that policy is likely tochange at the meeting on Thursday - all eyes will be on what he does. The Eurois sitting just below decision point giving a decent chance of a move in eitherdirection. The area between 1.10 and 1.1088 has been rejected multiple timeshowever this has not produced a strong move down, any move above 1.1088 shouldsee the highs from the one-time-framing move down taken out quickly up to 1.125gap. A sustained move lower will require a break of 1.0828 to target1.0728 and 1.0670, until then the high volume area 1.0974-1.0843 may provesticky again as those short on the rejection lose conviction on no break.

.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.