EURUSD - tested key area...

...and found buyers. The recent pull back from 1.1375 has put Euro longs under a lot of pressure particularly once trade got below 1.1059 and 200 MA, the last chance for buyers came on a re-test of the tight range (boxed) which coincided with trend line test. So far the area is holding and consolidating above, a move back above 1.1059 will be necessary to confirm the renewed strength. Any break into the range and through both trend lines should see a quick fall to 1.0775 as the area is well traded so no longer needs to hold.

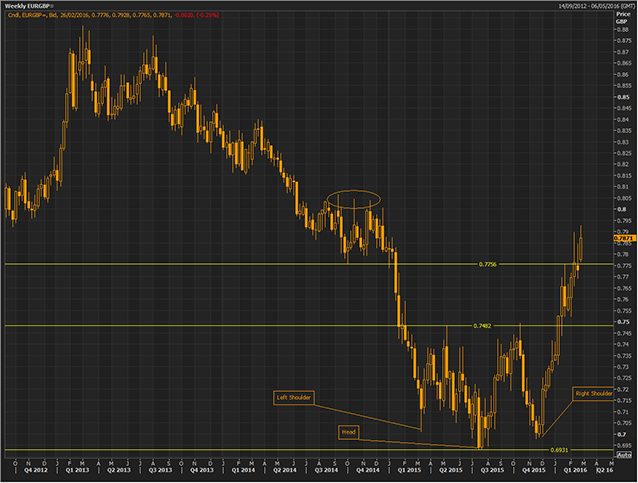

EURGBP - beware being late to the party

With the aforementioned strength in the Euro and the fears around the growing strength of the Brexit campaign, EURGBP looks fundamentally to be heading only one way. The technical picture looks strong too, there is an inside week break which will be confirmed with a close above .7485 today. A close above .7897 looks particularly bullish and the market is above .7756 pivot area. However, it is very easy to see the obvious; the Brexit story is everywhere now and many participants will have been playing it for a while. The inverse Head and Shoulders target is .7993 an overshoot runs into levels .8039-65 (circled) and could see resistance as profit is taken.

USDCAD - last chance for bulls

USDCAD has backed off strongly from mid January as Oil prices have stabilised around the low $30 area. Yesterday saw a break of long term trend line on increased volume and a move to 61.8% retracement of the recent swing higher, the key area is now 1.3457-35. A first time hold here is likely and will see a bounce towards 1.3635. Any close below could see some liquidation of positions with potential for a move to 1.3033.

.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.