Oil Finding Some Interim Sellers

After the break of the Falling Wedge pattern, we had 2 relatively strong weeks where the market pushed higher however last week the market topped out at 41.90 and closed back inside the range of the previous week. This setup is also know as a "Swing Rebound"which is technically a sign of at least a short term reversal in price action which has actually followed through this week with oil down on th week and trading below 38.39. With oil now losing some steam the real area for the bulls to hold is the 34.82 level. If we can hold here there is still a medium term bullish case in place with the double bottom staying in place.

Gold Stalling It's Rally But Holding the Falling Wedge

Gold in recent weeks has been struggling to hold a bid above the 1260.8 region with the last 7 weeks all closing at or below that level. With the strong bull run losing some steam, we have come back down to test the Falling Wedge pattern and still holding above the key area for the bulls at 1189. If we can remain above here in the short term the case still remains bullish with a target at 1307 area. If we break below here however, there could be some short term covering back into the 1147 level which was a strong pivot in the past.

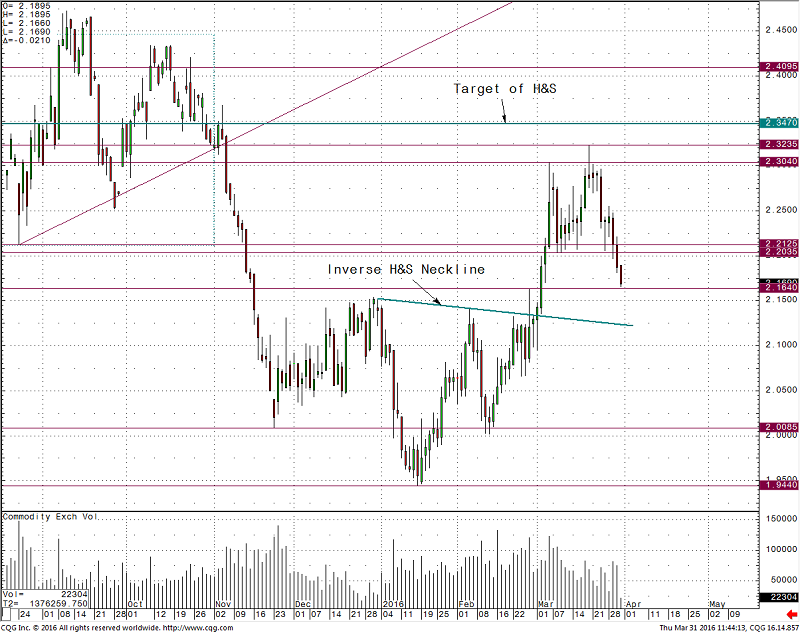

Copper Fails to Reach Inverse Head & Shoulders Target

Copper had broken a medium term bullish Inverse Head and Shoulders pattern at the beginning of March.This had sent the market higher as weak shorts were forced to stop out of their positions. After holding for some time above the 2.20-2.21 support, the market has broken below here this week and thus has failed to reach the measured target at 2.3470 above, leaving a top at 2.3235 in the interim. In the short term, the market has support at 2.1640 and to hold a short term bull bias,needs to hold above the neckline which comes in at about 2.12 at the moment.

.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.