Gold breaking trend channel...

...the downside move in Gold does feel like it has been coming but has been hard to judge. Yesterday's break out of its trend channel and close below recent swing low 1225.70 has now set a bearish tone. Next target to the downside is the band 1190.43-1182.5 where a bounce should materialise. The lows indicated by arrows at 1211.20 and 1201.63 should not be seen as support but rather as targets to scale shorts or even pyramid shorts for the more aggressive trader. The bearish sentiment will not diminish until a close above 1225.70 occurs.

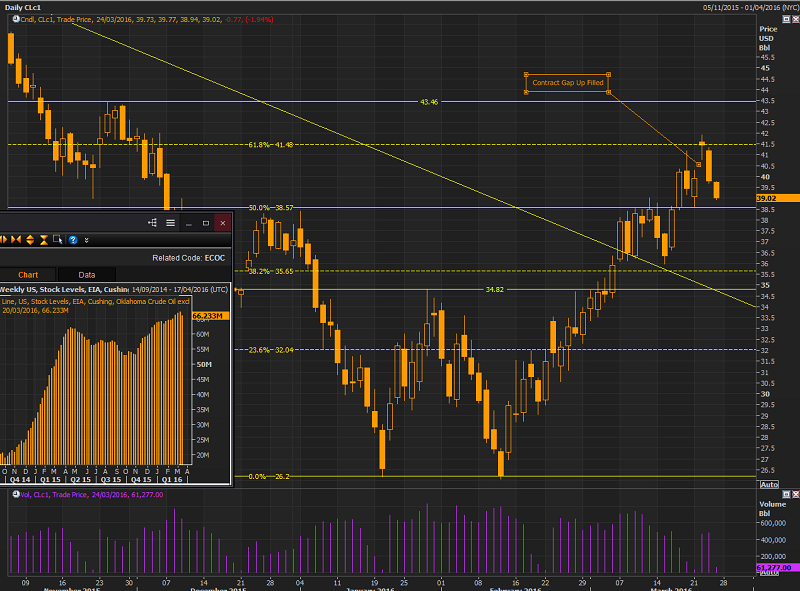

WTI drop since contract roll

The WTI complex is now in contango meaning that further out contracts are priced higher than the front month, this is why when it rolled to May contract early this week we got a gap up. We are seeing a pull back, first area of support to be tested is 50% and highs at 38.57-51. Any push lower will still be seen as a buying opportunity right down to 34.82 old high and trend line re-test. The smaller bar chart shows the inventory levels at Cushing where the WTI contract is priced, we are currently at record levels but saw a draw down last week , another this coming Thursday could start a new bullish move.

Silver Failed Inverse Head and A Shoulders

Silver sits at a critical levels for those still looking for upside moves, the attempts to break the inverse Head and Shoulders above 15.816 early this week has failed and now 15.13 provides last support for bulls. A break of this congested level could quickly see 14.57 trade. If 15.13 holds there could be an argument made that a cup and handle formation is now present and a break of 16.136 recent high can take prices above 16.36 up to 17.77.

.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.