Crude Oil HoldFalling Wedge

WTI Crude Oil has beenshowing a lot of signs of bullish price action recently since the confirmationof the Double Bottom at $26. From the break of the important $34.82 level, themarket tested the 38.39 area very quickly and now after a small pullback, themarket has come back to test the major Falling Wedge pattern only to break the39 level. With an inverse Head and Shoulders now formed, a close above thisneckline could be the impetus of a much large move with the only real structureabove at 43.46. If we fail to hold our bid here however the next port of callfor the bulls remains at the 34.82 area.

Gold Holding a Bid

Gold has been one of thebest performing asset classes in 2016 so far which is up some 23%. On a weekly time-frame, the market has held the 1189 to 1193 key support zone and now haseven held a bid above the 1226 level. Given the market has now closed multipleweeks above the bigger time frame Falling Wedge reversal pattern, a test of the1307 area is highly likely in my opinion so long as we can stay above the pinkarea.

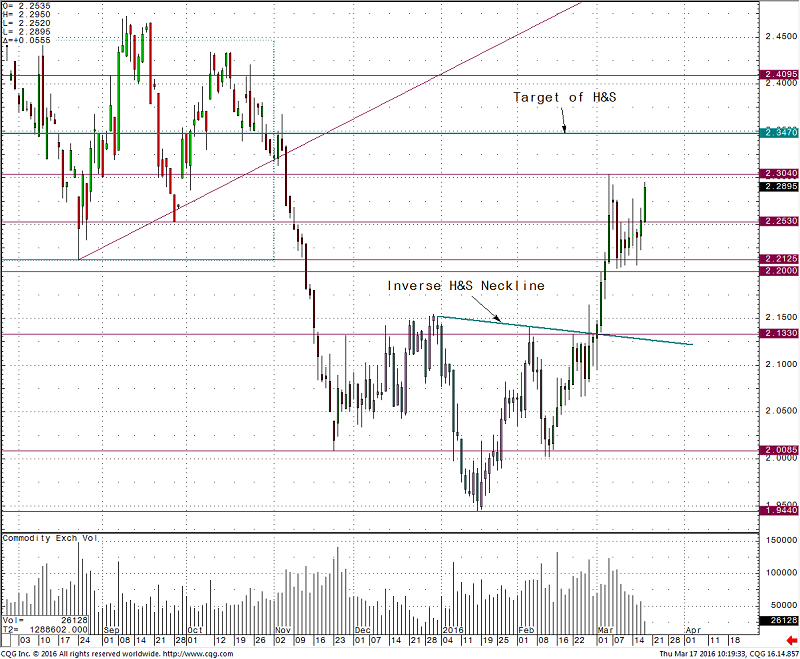

Copper Holds KeySupport Zone

Copper has performed wellin recent weeks after the break of a key Inverse Head and Shoulders pattern.This week, we have managed to hold a bid above the 2.20-2.2125 zone and is nowreaching out for the recent 2.3040 highs. If we manage to take this level out,the market should see the Target of the H&S which comes in at 2.3470. A movebelow the 2.20 area would likely put pressure on short term longs and only amove with a close below the 2.1330 region would negate the setup for me.

.

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD posts modest gains above 1.2450, BoE policymaker dampens hopes of summer rates cut

The GBP/USD pair recovers to 1.2450 during the early Wednesday. The downbeat US April PMI data and increasing appetite for the risk-linked space exert some selling pressure on the US Dollar.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.