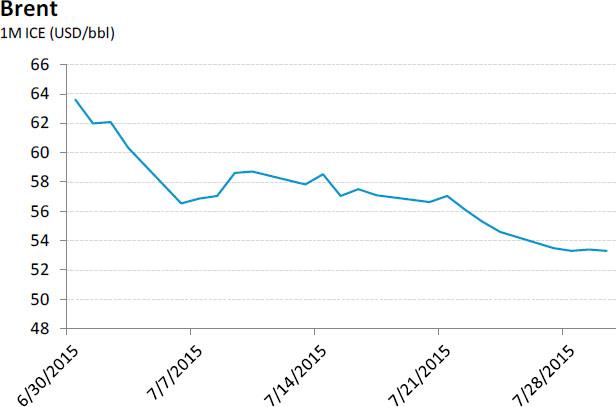

Crude

Although being set to decline in the fifth consecutive week, the oil price seems to have stabilized in recent days as the price of the front-month contract on Brent mostly remained in a relatively narrow two dollar band. Although US data on crude and products inventories unveiled that crude inventories fell quite sharply last week, the support for oil prices was eventually only limited. As regards the impact of yesterday’s US GDP estimate, a somehow mixed report rather weighed on prices, mainly via the strengthening US dollar.

Regarding the comments of OPEC Secretary General Badri, though he provided a relatively optimistic view of the market due to expectations of rising oil prices, his comments also suggested that the OPEC is likely to maintain its current policy of high oil production. This represents a negative risk for the oil price for the following quarters, especially due to the possibility of higher oil production in Iran.

Metals

With concern about an official rate hike in the US and in particular about the slow growth of Chinese demand, the price of copper has fallen to its lowest level since the crisis year of 2009. Although we anticipate a significant year-on-year decline in copper prices this year, we consider July’s fall as too strong, and therefore the price of copper might tend to grow in the months to come.

We believe that the affect of the drop in China’s stock markets on the real economy and consequently on demand for copper, will not be very strong. In addition, data for nearly the entire first half of the year indicates a deceleration of growth in the production of refined copper (compared to the end of last year), and thus the final market balance may be a lower surplus than we expected. On the other hand, the risks of our forecast are skewed towards a price decline.

Chart of the day:

Although being set to decline in the fifth consecutive week, the oil price seems to have stabilized in recent days...

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

US stock continue to stumble as traders rethink rates

US stocks grappled with uncertainty on Wednesday in the wake of a cautious string of commentary from the US Federal Reserve officials. The S&P 500 is currently experiencing its longest non-bullish streak in months.