Crude

Commodity markets have so far largely ignored talks about Greek debt and oil has been no exception. Yesterday, the oil price fell only slightly despite the fact it was another session of waiting in vain on an agreement between Greece and the creditors. Oil market has rather been watching signs of possible agreement on Iranian nuclear programme. The talks are to be held next week and in case the final deal was reached a relatively sharp decline in oil prices would be likely. Although a deadline for negotiations is set to 30th June, the talks could easily be extended if there was a solid chance for a deal to be reached (recall the talks that led to the framework agreement).

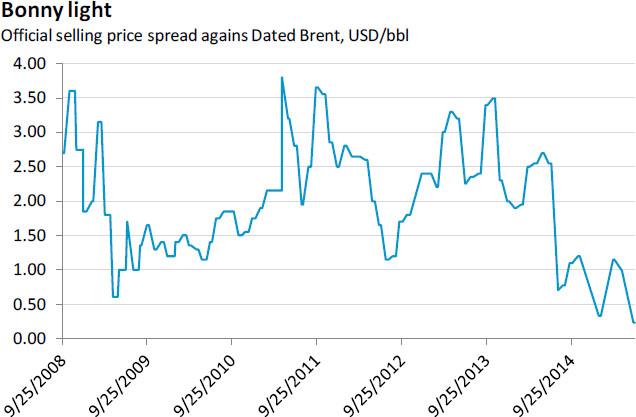

Recently, though, signs that oil market is more than well supplied have been mounting. Namely, Nigerian OSP differentials against Dated Brent (for example for Bonny light) are seen at the lowest level in ten years (see the chart below) as news that tankers full of Nigerian oil cannot find buyers hit the market. Moreover, Reuters said yesterday that North Sea Forties differentials hit the lowest level since the financial crisis.

If we take into account a surprising increase in gasoline inventories in the US last week (the US used to be important buyers of West African crude oil), this suggests that risks for oil prices continue to be skewed to the downside.

Chart of the day:

Nigerian OSP differentials against Dated Brent are seen at the lowest level in ten years…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.