Crude

After falling on Tuesday and Wednesday, oil regained some ground yesterday. Despite being under pressure early in the session, the price of the front-month contract on Brent increased by about 0.8%, mainly in a response to US crude inventories & products data.

The data showed that US crude inventories fell more than expected last week (-2.8 million barrels vs. expected -0.9 million barrels). Though the decline in stocks could be to some extent attributed to a lower volume of imports, a relatively sharp decline in gasoline stocks is quite surprising as refinery capacity utilization increased last week. This suggests a strong demand for gasoline at the start of this year’s driving season which reflects, among others, lower oil price.

Metals

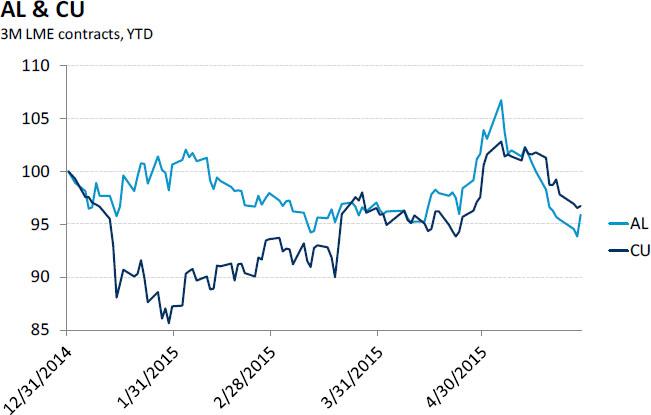

After falling for ten straight sessions and hitting a fourteen-month low, the aluminium price rebounded yesterday. Although we expect more balanced aluminium market this year (in comparison with recent past) and therefore expect the price of the metal to increase towards the year-end, figures for the first quarter suggest that risks for our view are skewed rather to the downside.

It is probably not surprising that the key risk is further development in China; not only because of its huge share on total world consumption of the metal, but also due to the soaring metal production (in the first three months, production of aluminium increased by about 30%). Growth in China’s production more than offsets a sharp production decline elsewhere in the world, particularly in the Russia, US and South Africa.

Chart of the day:

After falling for ten sessions in a row, the aluminium price rebounded yesterday…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.