Crude

After failing to settle above a resistance at 62.5 USD/bbl, the oil price is set to decline this week. Still, being traded at about 61 USD/bbl, oil is seen well above levels recorded after the release of the US weekly oil stock report on Wednesday.

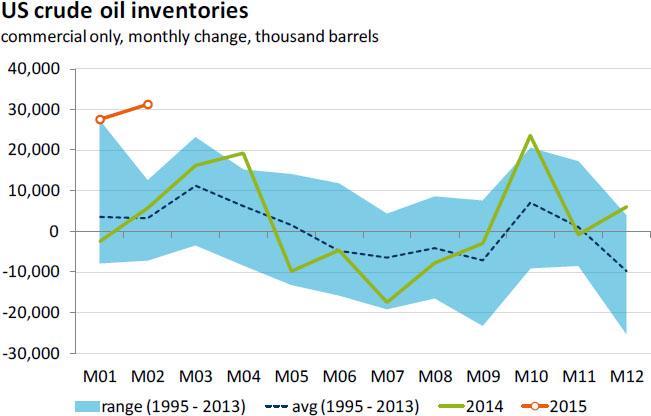

Regarding the report, it showed yet another sharp increase in US commercial crude oil inventories (see the chart below). In fact, US commercial crude oil stocks may have increased at the fastest pace since March 1990 (weekly data may be revised along with the release of a monthly report). In any case, if we take into account that stocks of products also increased more than expected, this leads us to maintain our short-term negative bias on oil prices. Still, there’s no doubt that apart from today’s US labour market data (which may in our view rather weigh on oil prices), market will also pay close attention to the Baker Hughes’ Rig Count report (which is to be released later in the afternoon).

As for more recent news, Libya halted production at eleven oil fields due to attacks of IS militants and the country’s oil output is reported to be around 400 thousand barrels per day (which is well below Gaddafi’s era level). Although the spread between the front and twelve month contract on Brent (ICE) has tightened over the past few weeks, the overall situation remains calm and market seems to remain (more than) well supplied.

Metals

Pressure on the price of gold has been mounting as the US dollar strengthened to more than an eleven-year high yesterday. Although we see risks for today’s US payrolls report to be skewed to the downside, we expect no major price action after the figures are released. On the other hand, should the data surprise on the upside, the gold price may fall as low as to 1180 USD/toz.

Chart of the day:

In February, US commerical crude oil inventories may have increased by the most since March 1990…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.