Crude

After hitting a two-week high on Friday, the oil price slumped yesterday and settled back below 60 USD/bbl (1M ICE Brent). Apart from weaker US data, comments of Iran’s Foreign Minister may have played some role. The minister said that “a deal on Iran's nuclear programme could be concluded this week if the United States and other Western countries had sufficient political will and were agreeable to removing sanctions”.

Though the progress has been made in nuclear talks between Iran and its counterparts, we remain cautious with respect to lifting the sanctions and consider such a scenario as less likely. On the other hand, if the deal was struck, the market would have to digest as much as 1 million barrels of oil per day more in comparison with current state. This would obviously have a negative impact on prices, especially towards the backdrop of already oversupplied market.

Metals

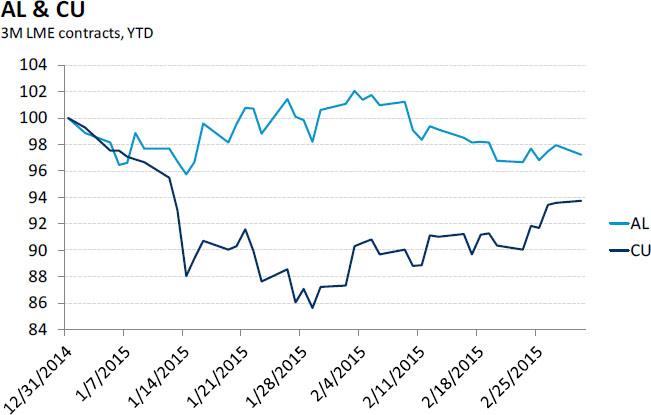

The weekend’s decision of China’s central bank (PBoC) to cut interest rates only had a little impact on base metals prices yesterday; copper price (3M LME) hit a seven-week high at first but later in the session pared gains and increased by mere 0.2% while the aluminium price even declined by about 0.8%.

Although China is by far the largest consumer of base metals and recent step of PBoC signals that the authorities stand ready to support the economy, the pace of economic growth is expected to decline this year. This should also translate into a slower growth of demand for commodities, including copper. We therefore think that copper has only a limited room for further gains though, at the same time, we perceive a sharp sell-off in mid January as exaggerated and we stick to our 2015Q2 forecast for average price of copper slightly below 6000 USD/t.

Chart of the day:

We perceive a sharp sell-off in mid January as exaggerated and we stick to our 2015Q2 forecast for average price of copper slightly below 6000 USD/t...

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.