Crude

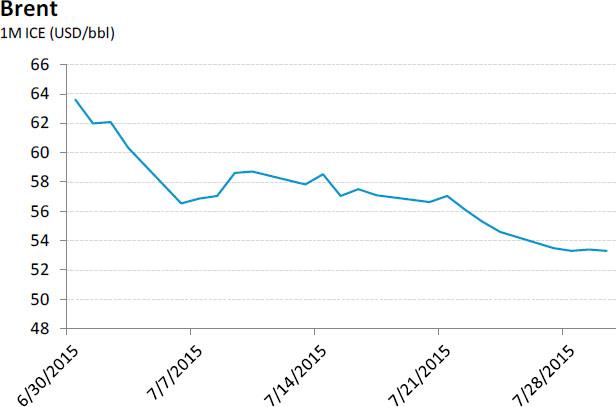

Although being set to decline in the fifth consecutive week, the oil price seems to have stabilized in recent days as the price of the front-month contract on Brent mostly remained in a relatively narrow two dollar band. Although US data on crude and products inventories unveiled that crude inventories fell quite sharply last week, the support for oil prices was eventually only limited. As regards the impact of yesterday’s US GDP estimate, a somehow mixed report rather weighed on prices, mainly via the strengthening US dollar.

Regarding the comments of OPEC Secretary General Badri, though he provided a relatively optimistic view of the market due to expectations of rising oil prices, his comments also suggested that the OPEC is likely to maintain its current policy of high oil production. This represents a negative risk for the oil price for the following quarters, especially due to the possibility of higher oil production in Iran.

Metals

With concern about an official rate hike in the US and in particular about the slow growth of Chinese demand, the price of copper has fallen to its lowest level since the crisis year of 2009. Although we anticipate a significant year-on-year decline in copper prices this year, we consider July’s fall as too strong, and therefore the price of copper might tend to grow in the months to come.

We believe that the affect of the drop in China’s stock markets on the real economy and consequently on demand for copper, will not be very strong. In addition, data for nearly the entire first half of the year indicates a deceleration of growth in the production of refined copper (compared to the end of last year), and thus the final market balance may be a lower surplus than we expected. On the other hand, the risks of our forecast are skewed towards a price decline.

Chart of the day:

Although being set to decline in the fifth consecutive week, the oil price seems to have stabilized in recent days...

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.