Crude

The oil price is set to decline for the fourth week in a row. On Wednesday, the oil price fell quite sharply after the release of a weekly report on US crude and product s inventories. The report showed an unexpected build in crude oil inventories. Moreover, quite significant increase was recorded also in Cushing (WTI delivery point) despite the fact that both US and US Midwest refinery utilization increased last week. On the other hand, the report showed that gasoline inventories fell quite sharply which indicated that demand for gasoline in the US remains strong. The decline in gasoline inventories never the less only mitigated overall bearish tone of the report.

The question however remains, as was already pointed out by the International Energy Agency, what will happen with oil prices after US driving seas on ends in September. Though demand for gasoline is likely to remain strong er compared to the previous years as cheaper oil spurred some demand, seasonally lower demand will likely weigh on gasoline prices which could consequently undermine prices of oil. The strong US demand for gasoline compared to that for diesel already has consequences for prices of oil products in NW Europe – this summer, a spread between gasoline and diesel prices h its the record levels since at least 2003.

Metals

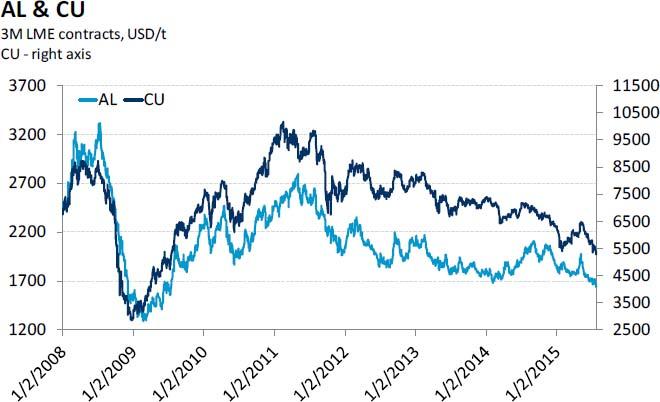

Pressure on metals prices has been further mount ing this week. Early today, the flash estimate of China’s PMI for June fell significantly short of market expectations, which only supports worries about the “ true state ”of Chinese economy. In case of aluminium, whose price is seen at the lowest level since 2009 (see the chart below), somehow bleak demand picture is accompanied by quickly rising Chinese production of the metal .

Moreover, market jitters have intensified as the time of the first Fed hike in years seems to have been approaching. This also has a negative impact on gold; price of the yellow metal declines sharply this week and unlike previous cases, the decline spurred more significant demand response neither in China nor in India . Physical premiums in both countries remain quite low and thus do not indicate more significant demand pressures.

Chart of the day:

The price of aluminium fell to the lowest level since 2009 .

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.