Crude

The oil price got under a modest pressure today in early morning as China’s PMI flash estimate for March surprised significantly to the downside and Saudi Arabia said that its oil production is close to 10 million barrels per day. Moreover, Saudi’s oil minister Naimi said that his country is willing to supply even more oil if needed. The latest comments thus confirm that the kingdom sticks to its policy announced in November last year and is not willing to give up its market share in favor of other producers.

Regarding news, CEO of Schlumberger – one of major oilfield service companies – said that a sharp decline in oil prices could have a permanent effect on US shale oil producers in a sense that oil producers would be more prudent while investing into new production capacities. Let us recall that, according to the latest EIA Drilling Productivity Report, oil production may slightly decline in three major US shale oil producing regions as soon as in April as a result of slumping number of active rig count and high decline in oil production from legacy wells.

We believe that factors mentioned above support our scenario that bets on a decline in oil prices in months to come and their recovery above current levels towards the end of this year.

Metals

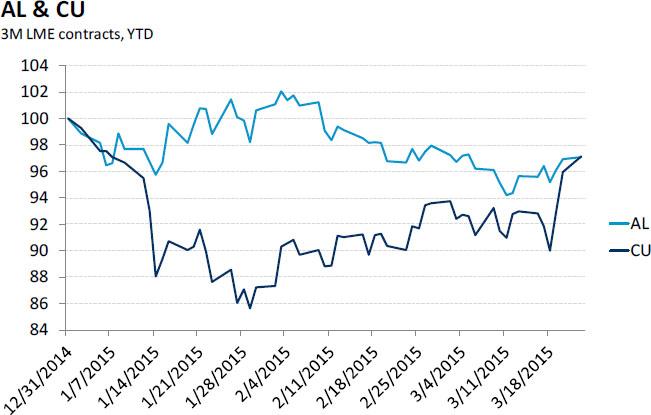

After hitting a nearly four-month high in early morning, the price of copper (LME 3M) got under modest pressure after the release of flash estimate of China’s PMI. After having expanded in February, the Chinese manufacturing sector fell back into contraction in March as new orders shrank. The HSBC manufacturing PMI dropped from 50.7 to 49.2, its lowest level in 11 months, while only a marginal decline was expected.

Although base metals prices are traditionally sensitive to any signs of slowing demand in China, the impact of worse than expected PMI has so far been rather limited as market probably bets on an introduction of pro-growth measures should the prospects of China’s economy further deteriorate.

Chart of the day:

Copper price hit a nearly four-month high today in early trading

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.