Crude

Although yesterday’s Energy Information Agency (EIA) data did not confirm Wednesday’s report from the American Petroleum Institute as far as the volume of increase in crude oil inventories is concerned (the API report had foreseen more than 14 million barrels build in inventories which, if it had been confirmed, would have marked an all-time high), it left the overall message intact. The data showed about twice as large build in stocks than the one that had been anticipated by analysts at the beginning of this week. The oil price therefore fell by about 0.5% yesterday while the US benchmark WTI even lost about 1.9% as inventories in Cushing, the delivery location of NYMEX WTI futures contract, rose by about 3.6 million barrels. Rising stocks in Cushing suggest that traders have recently been taking advantage of relatively wide contango in the front-end of oil forward curve.

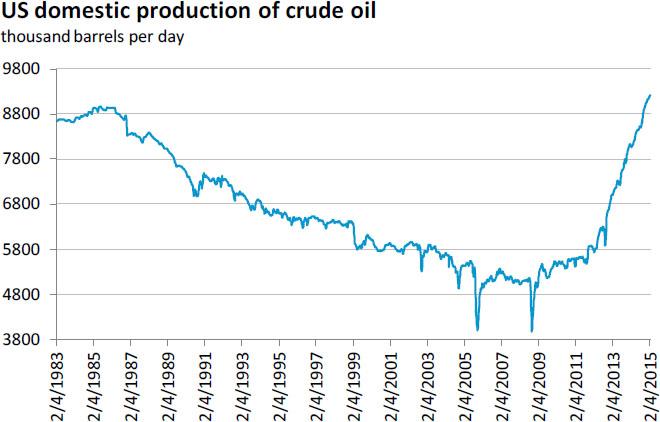

All in all, recent EIA data reminded us that although the supply elasticity of “shale oil” likely is much higher than that of “conventional oil”, it will take some time before the impact of lower oil prices on the US supply is more pronounced. For example, the data showed that US domestic crude oil production increased by more than 800 thousand barrels per day visà- vis June 2014. Let us recall that in the meantime, the oil price fell by about one half…

Metals

Price of gold extended previous declines yesterday and today is therefore seen close to a 1-1/2 month low despite the fact that much is at stake in talks on Greek debt today. If the negotiations fails, for the euro area the immediate contagion might be contained (enough backstops available), but it would be politically disastrous for the internal cohesion of the euro zone and open the way for more defections later on. Geopolitically, it would strengthen the hand of Russian president Putin who could continue to undermine the East flank of the EU.

With respect to what was said above, common sense points to an agreement and that’s probably also the reason why the overall markets remained sanguine...

Chart of the day:

US domestic oil production continues to rise.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.