Crude

The oil price settled barely changed yesterday even though the International Energy Agency (IEA) said it revised its outlook for both 2014 and 2015 oil demand growth to the downside. The agency thus echoed similar comments of the US Energy Information Agency (EIA). The EIA even said that “[t]he recent slowdown in demand growth is nothing short of remarkable”.

Both agencies also mentioned that Libya’s recent rebound in oil production and exports contributed to decline of Brent price. This is slightly surprising as the country’s government had difficulties to reach a deal with anti-government rebels from the eastern part of the country. Moreover, despite the fact that security situation in Libya has worsened dramatically over the past couple of months, the country’s PM said on Wednesday that oil production is expected to reach 1 million barrels per day in October.

Let us recall that favorable fundamentals are illustrated by contango in the front-end of Brent forward curve. A spread between the front-month and six-month contract is seen at the lowest level since June 2010 and has been negative for the longest period of time since 2010. A combination of recent increase in Libya’s oil production with weaker than expected oil demand thus pose a clear downside risk for our oil price forecast for the rest of this year.

Base metals

Copper price fell quite sharply over the past couple of days and the red metal is heading for the biggest weakly loss since mid July. Apart from prospects of faster supply growth in the rest of the year, copper price and base metals in general have been under pressure of strengthening US dollar.

In the meantime, aluminium price has been falling as well this week and is set to post loss for the first time in four weeks.

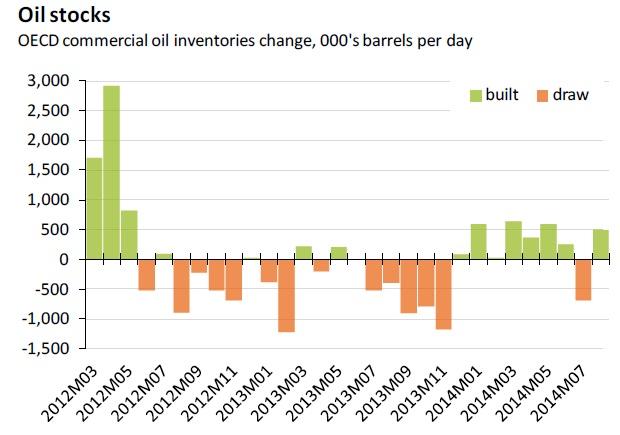

Chart of the day:

IEA said yesterday it revised its forecast for global oil demand growth for both 2014 and 2015 and hence echoed similar comments of the US EIA. The chart shows that - with the exception of July – global commerical oil inventories have been rising over the past couple of months.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.