Crude

The international agreement, reached at the end of last week in Geneva, to avert a wider conflict in Ukraine was faltering already yesterday with pro-Moscow separatist gunmen showing no sign of surrendering government buildings they have seized. The price of oil thus remains supported and the front-month contract on Brent is trading at 110 USD/bbl at the time of writing of this note.

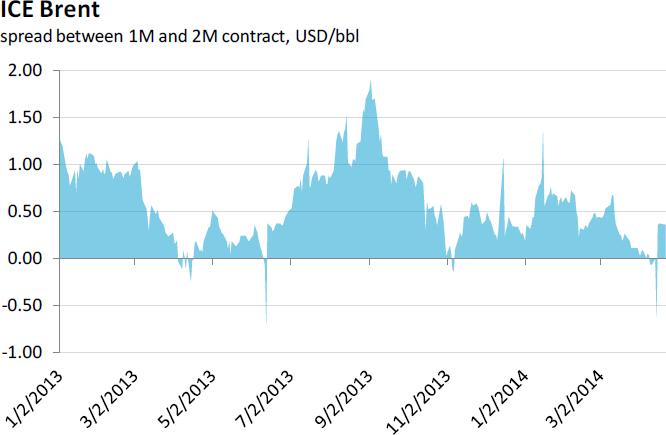

On the other hand, while the backwardation in the front-end of the forward curve (ICE) widened in the last couple of days (after the expiration of the May contract), it still remains at reasonable levels and indicates that quite calm situation in the market prevails; the spread between the front and second month contract is about 40 cents per barrel.

Base Metals

Nickel price (LME) hit a new fourteen-month high amid worries of tighter western sanctions imposed on Russia, a major refined-nickel producer, due to reluctance of pro-Russian protesters to fulfil the Geneva agreement reached last week. The metal already gained more than 30% since the end of the previous year and has by far outperformed the rest of base metals complex.

Meanwhile, the three-month copper has watched slowing Chinese economy and the price of the metal falls towards 6600 USD/t level in early trading after the Easter holiday. From this point of view, tomorrow’s flash PMI figures (HSBC/Markit) will be watched closely as the markets expect minor improvement vis-à-vis March reading of 48.0.

Chart of the day:

While the backwardation in the front-end of the forward curve (ICE) widened in the last couple of days (after the expiration of the May contract), it still remains at reasonable levels and indicates that quite calm situation in the market prevails…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.