Crude

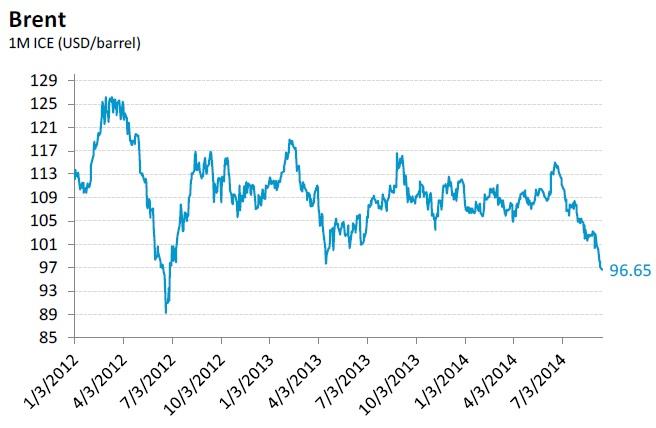

On Monday, weaker than expected China’s August industrial production data weighed on base metals prices in particular but crude price fell as well. The front-month contract on Brent even hit a 26-month low yesterday (see the chart) as demand concerns (which stem to a large extent from worries about pace of growth of China’s oil demand as we already pointed out on Friday) got additional support.

Apart from the FOMC meeting which starts today, markets may watch results of a Vienna meeting between Russia and the OPEC. Although the meeting had been scheduled before the recent oil price drop and its main theme should be a discussion of closer cooperation of the cartel and Russia, talks about a reaction to falling prices cannot be excluded.

Let us however recall that prospective decline in Saudi Arabia’s oil production in months ahead should not be interpreted as a result of some backstage talks and is likely anyway as it seasonally drops over the winter. Moreover, a room should also be made for Libya’s oil which recently returned to the market in an unexpectedly large volume.

Base Metals

Disappointing China’s IP data released on Weekend sent base metals prices lower on Monday. While copper performed relatively well and three-month price (LME) dropped by only 0.3%, aluminium slumped by nearly 2% and therefore posted losses in the fifth consecutive session.

Chart of the day:

Brent hit 26-month low yesterday..

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.