Crude

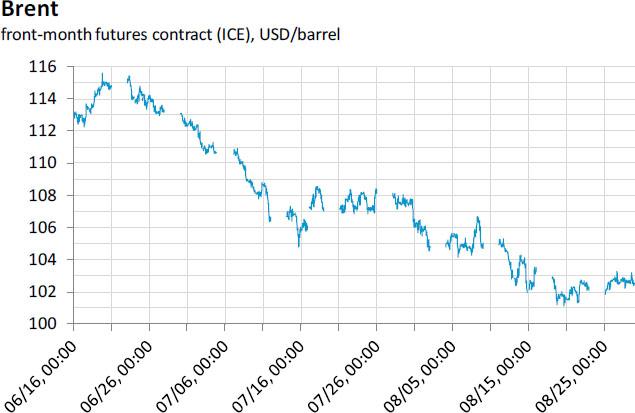

A fresh round of tensions between Russia and the West as well as clashes in eastern Ukraine and talks about possible presence of US soldiers in the country have so far had no significant impact on the price of oil. The front-month contract on Brent has been trading sideways in the past three weeks and yesterday settled just shy below 102.50 USD/bbl.

Although geopolitical tensions remain high in general (Ukraine, Libya, Syria/Iraq, Israel, …), their oil market impact is – at least for the time being – quite small. In a combination with relatively strong supply in Atlantic basin and muted demand (despite quite strong pick-up in ARA refinery margins over the past couple of weeks), they do not generate more significant upside pressure on oil prices. At the same time, however, we think that the existence of the risks limits room for further decline in oil prices below 100 USD/bbl level.

Base Metals

Generally higher risk aversion apparent for example on equities’ prices weighed on commodities yesterday; the three-month copper price (LME) fell well below 7000 USD/t yesterday and hit a five-day low while aluminium price fell by about 0.2%. Today in early trading, however, aluminium is trading at a new 1-1/2 year high.

Regarding copper, although we remain bearish towards the year-end and in the medium term due to combination of several factors (slowdown in Chinese demand growth, accelerating supply), we are a bit cautious as concerns expectations of more significant decline in prices for the weeks ahead as LME stocks of the metal remain in sight of six-years low. Persisting tightness in LME market is also signalled by backwardation in the front-end of the forward curve (cash-3M spread has been mostly trading above zero since mid December last year).

Chart of the day:

Oil has been trading sideways in the past three weeks…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.