Crude

The price of Brent oil is set to decline in eleventh out of thirteen last sessions as the front-month contract (ICE) price dips below 110 USD/bbl level today in early trading. More or less the same factors which weighed on the oil price over the past few days are in play today as well, that is, a relatively stable situation in Iraq along with good news from Libya. As for the latter, Libya’s Oil Ministry said it has 7.5 million barrels of oil ready to be exported from reacquired ports of Ras Lanuf and Es Sider (which have a capacity of more than 500 thousand barrels per day).

In the meantime, however, the country’s oil production rose slightly to “only” 326 thousand barrels per day, according to a spokesman of the National Oil Corp, as oil from the western El Sharara oilfield remains blocked by separate protests. Although the oil production, which is still well below its historical standards, clearly limits room for increased exports from the country in the weeks to come, even a modest increase in volume of oil shipments from Libya could weigh further on North Sea oil prices. Situation in the physical market seems already to be very comfortable at the moment as prices of CFD contracts (short-term Dated Brent swaps) are seen at the lowest level in two years.

Base Metals

Base metals were trading mixed and on average posted only small gains on Monday. Copper price still remains in sight of multi-month highs, despite news about possible agreement between Freeport McMoRan and Indonesia’s government that could resolve a dispute about tax on exports of copper concentrates from the country. The tax levied on mineral ore exports early this year certainly contributed to an upward pressure on copper prices in recent months as it halted exports of copper concentrates from the country. Let us recall that Indonesia’s Grasberg mine is - with last year’s production of about 420 thousand tonnes of the metal, or nearly 3 % of global mine production - one of the world’s largest copper mines.

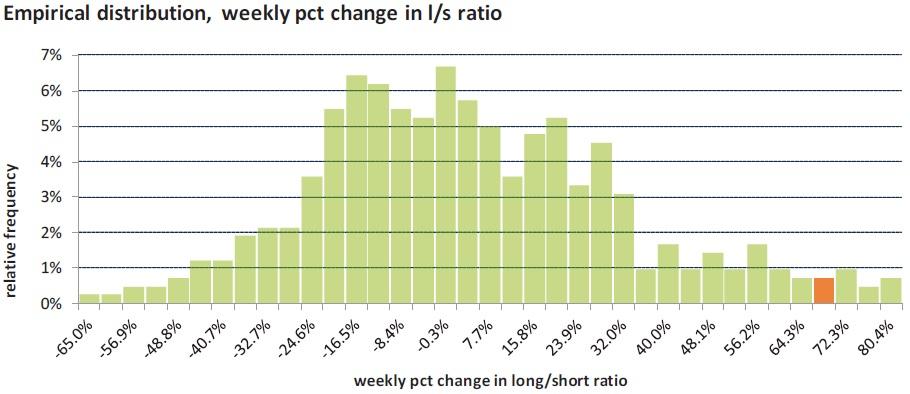

Chart of the day:

Money managers demand for COMEX gold futures surged last week…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.