Crude

Rising tensions in Ukraine have so far overshadowed mixed news from Libya and the price of Brent (ICE) hit a six-week high on Monday. Apart from events in Ukraine, stronger than expected March US retail sales have supported the price of oil yesterday.

Regarding Libya, Reuters reported yesterday that despite a deal between government and rebels was reached on unblocking ports that had been under rebel’s control, the port of Zueitina – one of the major ports in the eastern part of the country which used to load about 200 thousand barrels of oil per day – is still not under control of Libya’s government.

Let us recall that Libya is important source of oil mainly from the perspective of Mediterranean refineries that should be gradually returning from a seasonal maintenance in weeks to come and prospective increase of exports from Libya could therefore help to ease the pressure on oil price. On the other hand, yesterday’s news suggests that oil from Libya cannot be overly relied on.

Base Metals

The recent events in Ukraine which could spark a military action against pro-Russian rebels (its likelihood has been steadily rising) supported nickel price on Monday. The metal hit a fourteen-month high yesterday as markets worry about tightening of western sanctions against Russia, which is the major producer of the metal (its refineries account for about 15% of World capacity).

Let us recall that tensions between the West and Russia are not the only source of nickel’s strength this year. The price has been supported by Indonesia’s new export rules imposed on mineral ores which could turn the market balance from last year’s surplus to a small deficit this year.

Chart of the day:

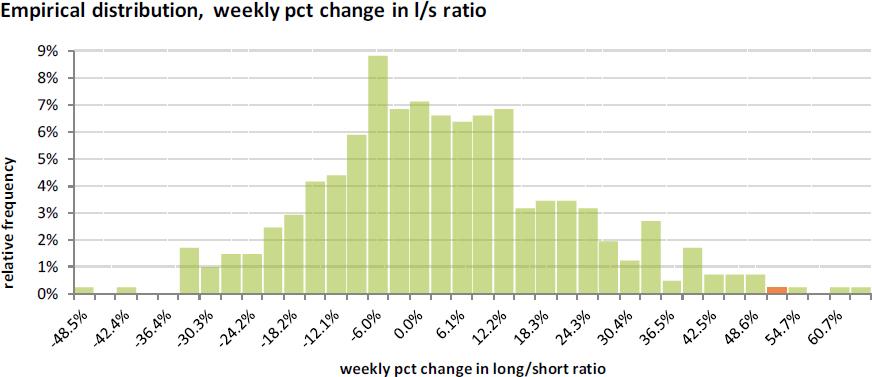

Money managers boosted their net long position in WTI futures last week by cutting their short positions.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.