121k jobs in 31 days? That is an impressive 3900 per day. Something is wrong somewehere - we are just not sure where at the moment.

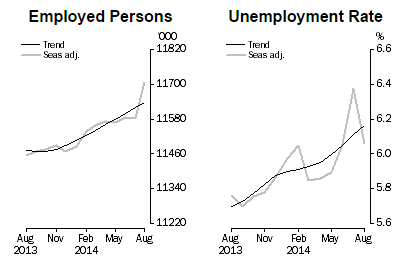

Only last month we saw unemployment rise from 6% to 6.4%, a 12-year high, and reminding the markets of Glenn Stevens earlier comments that "expect unemployment to rise before it becomes lower". I suspect he was talking more than a couple of months horizon though.

Job ads were up 0.1% m/m earlier this week and whilst this gave an expectation of improved employment not many (if any) saw this number coming in today. Australia has not witnessed over 100k jobs created in a month since 2003, so nobody was expecting such a whopper this month. However whilst the number in itself is impressive it should also be remembered that this is a volatile number at the best of times and this is only the 2nd month since the new calculation method has been used.

Technically:

That didn't stop the market reacting to see A$ break up through 92c resistance, which only this morning looked like an uphill struggle. Whilst the Australian Dollar continues to enjoy the bounce form the lows the bigger picture remains bearish from a technical perspective. The Weekly charts have been exhibiting a topping formation for some time and only yesterday confirmed a Head and Shoulders Pattern to project downside targets around 89-90c. I expect traders to begin fading any rallies below 0.924 once the excitement has dies down from today’s figures.

Moving On:

With the headline domestic figure over for the week the markets will now focus on FOMC staff projections and rate statement next week, where markets are continuing to price in a Hawkish outlook for the US. But with high expectation already priced in, we should also be on guard for some Greenback losses should the FED fail to deliver. Again.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.