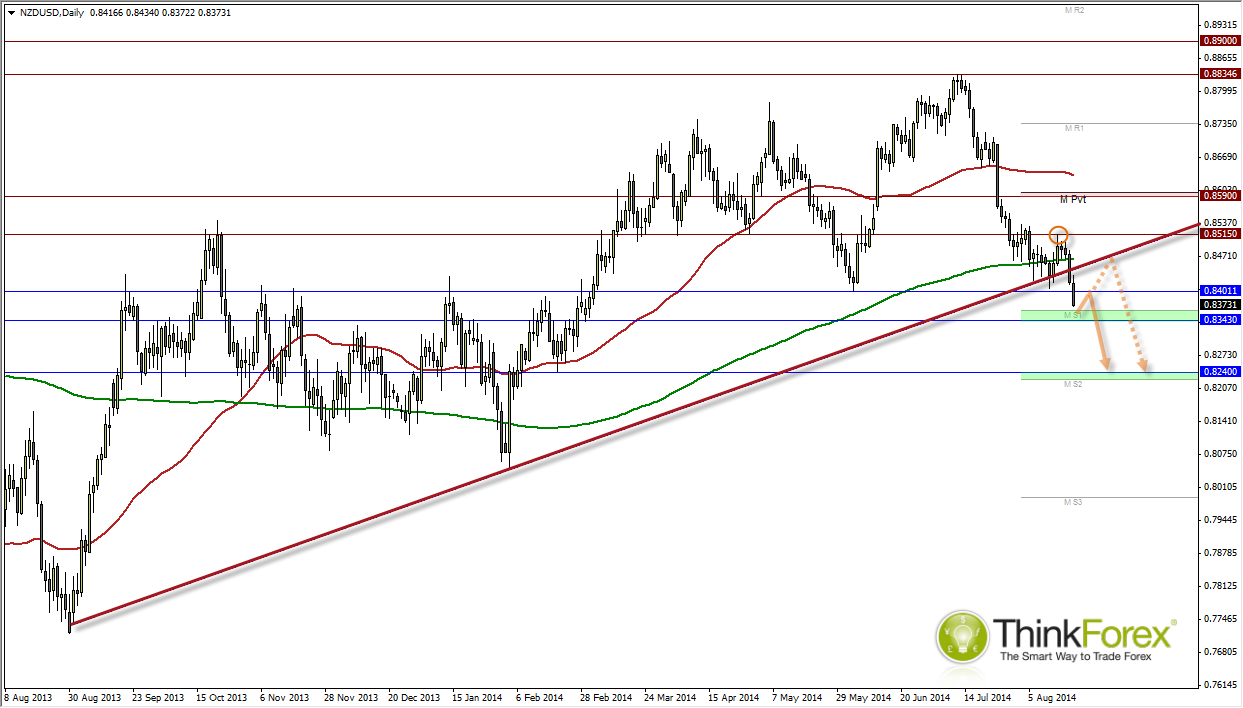

The key level of support have been breached against the Greenback to suggest the bearish move may be part of a larger structure, in what has been a relatively action-packed Asia session.

I have been keeping a close eye on the 84c swing low and had expected this level to hold for the foreseeable future. Needless to say during a volatile Asia session the level finally broke and provides a couple of key levels to consider for short positions.

At time of writing and due to the velocity of the decline I expect 0.360 supports (MS1) to be tested. Whilst this may only leave room for a few extra pips on the bear side there is a good chance this level will hold into Europe/London open as we witness profit taking and long initiated by the brave. I have highlighted the broken trendline and these do have a tendency to get retested once broken. However the trendline is not exactly precise so we need to allow lots of room for noise around it, assuming we do see a sizeable retracement towards it.

Due to the bearishness of the decline I suspect we won’t be seeing this retracement any time soon. A more likely level of resistance to consider for selling into may be 0.84-43 for intraday traders.

- Once/If we break below MS1 then next obvious target becomes 0.824 where we see MS2 and historical S/R.

- Only a break back above 0.853 swing high brings into question the likelihood of a bearish move down to 0.824.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Financial Services Guide (FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by going to www.thinkforex.com/about-us/legal to download at this website or hard copies can be sent by contacting the offices at the number above. The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. © 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents. The information in this email , the links provided are for general information only and should not be taken as constituting professional advice. ® 2013 ThinkForex All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.