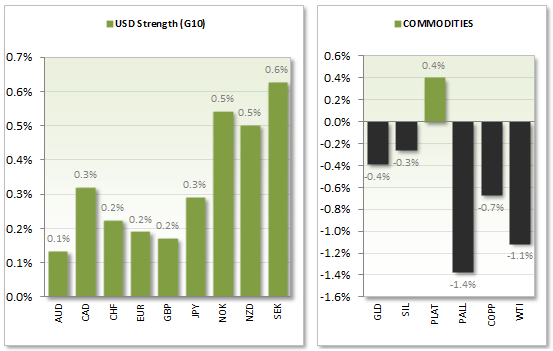

With the USD the best performing G10 currency this week the markets await important US data from G2 GDP, FOMC meetings and Nonfarm payroll to see if it can extend its bullish reach.

The Greenback has continued the bullish sentiment of the previous 2 weeks, breaking to 6-month highs as consumer sentiment came in its highest since October 2007. With the USD the best performing G10 currency this week the markets await important US data from G2 GDP, FOMC meetings and Nonfarm payroll to see if it can extend its bullish reach.

If tonight's GDP comes in at 3% or above then this would more than erase Q1 contraction of -2.9%, and help the Greenback remain support at the highs. Whether it will extend its bullish reach further is up for debate, as I do not think this will put pressure on the FED to raise rates sooner. Traders would do well to remember that the FED's preferred measurement of inflation is PCE (personal consumption expenditure) which is 1.8% y/y. below the FED's 2% target, and released this Friday along with employment data.

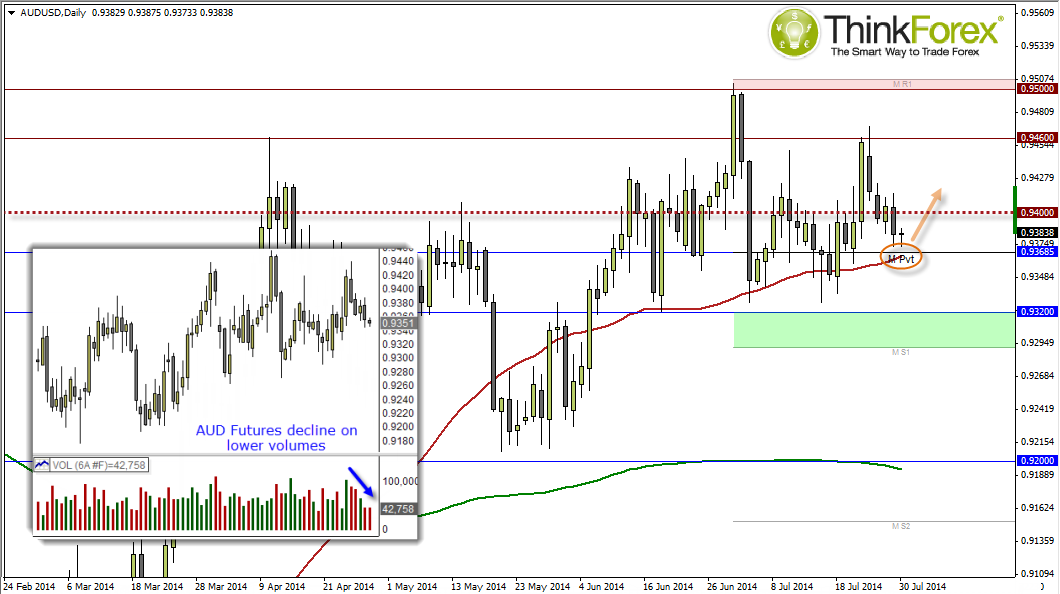

Whilst A$ continues to meander around 94c the fact it is managing to hold ground whilst the Greenback is a testament to A$ strength. Whilst we now trade back below 94c it should be noted that the decline has been achieved on declining volume (which suggests a lack of sellers) and price has now stalled above the 50-day MA (moving average) and monthly pivot support.

I expect to remain around current levels as the markets quietly await tonight's GDP data.

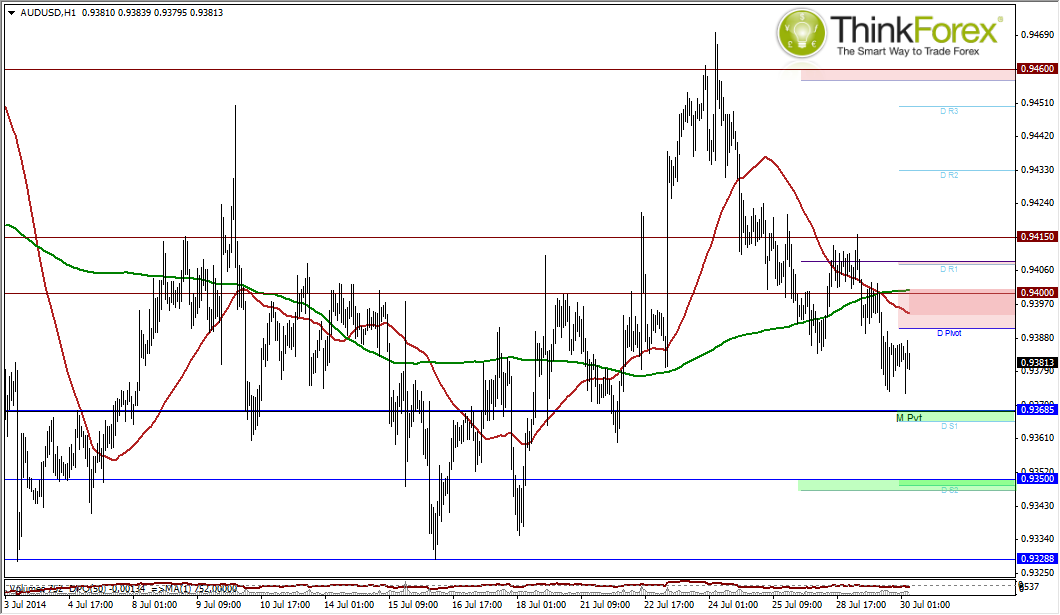

Technical support is around 0.9365 and holding above its 50-day average. If US GDP falls below target and this is accompanied by further hesitancy from the FED in regards to interest rates then this should help A$ stay above 0.9365 support and break above 94c again. Then the question becomes "can it stay above this level" for more than a couple of sessions.

However if GDP comes in or above 3% and we see a Hawkish statement from FOMC then we could see A$ break below key support of 0.9368 and target 0.935

After tonight the markets will then focus on China PMI, Australian Commodity prices and of course the data-dump from the US on Friday. With Nonfarm payroll and PCE being released together if the data combined all leans towards a more bullish or bearish bias for USD then we should see an end to the current deadlock between AUD and USD.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.