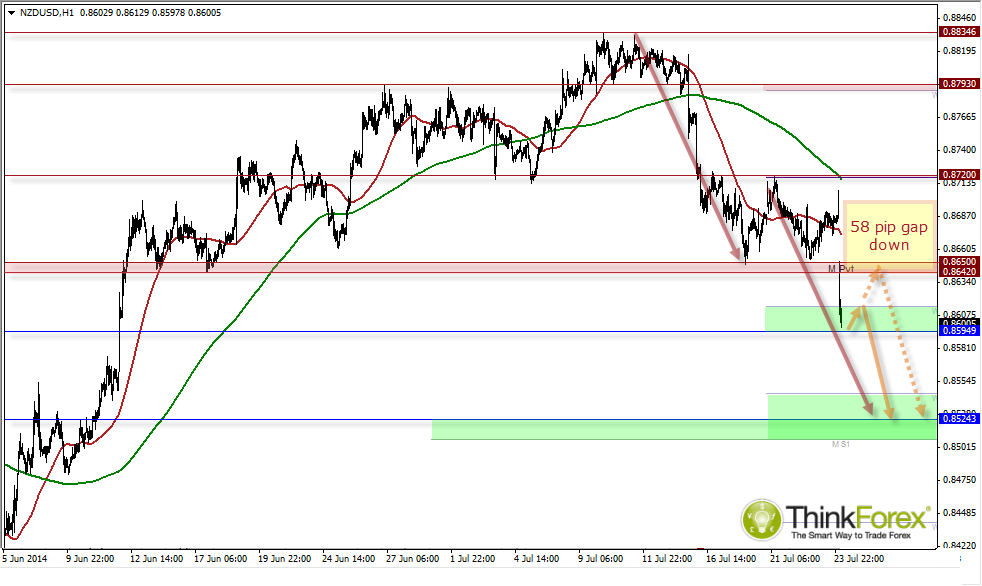

As expected, RBNZ raised rates by 25bps, for an overnight cash rate of 3.5%. Despite the rise price sold off immediately, with Dovish comments from Wheeler keeping prices at 6-week lows.

Key comments from RBNZ Graeme Wheeler

- Reserve Bank Of NZ Raises Cash Rate Target 25 Bps To 3.50%

- Economic Growth In Trading Partners Has Eased, Appears Temporary

- House Price Inflation Has Moderated Further Since June Statement

- Christchurch Rebuild, Immigration Adding To Housing And Household Demand

- Fall In Prices For NZ Export Commodities Reduces Primary Income

- Inflation Remains Moderate, Strong Growth Absorbs Spare Capacity

- NZ Dollar Unjustified, Unsustainable, Potential For Significant Falls

- Further Rate Increases Depend On Monetary Policy Impact, Data

- Prudent to Assess Impact Before Interest Rates Adjusted Further

So in summary, unless we see improved data then rates will remain at 3.5% for some time. An interesting observation is that the Kiwi Dollar sold immediately when the rate decision was released which suggest longs saw it as an opportunity to get rid of their positions. The clues preceding the bearish move were in how price declined from the highs on lower dairy prices and soft inflation data - it covered the same distance in 3 days which took the bulls 20 days to accomplish.

The accompanying rate statement has kept prices down as opposed to driving the sell-off, and even a positive trade balance that soon followed was not enough to stall the decline.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.