A snapshot view of yesterday’s New York - London session with technical notes.

BoE Votes show no change in the stance for interest rate rises - all coma in unanimously to remain on hold. However in the following statement Carney stated rate rises are drawing closer. Mortgage approvals remained steady but Retail Sales fell short of expectations at +0.1% vs +0.3% forecast. This saw GBP sell off early London trading but recover losses through the session.

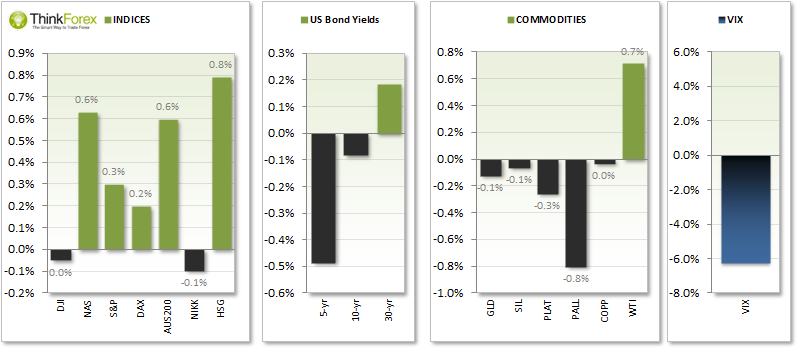

S&P500 closes at record highs following positive earnings

VIX (fear gauge) retreats further and now sits at similar levels pre Malaysian Flight MH17 crashed

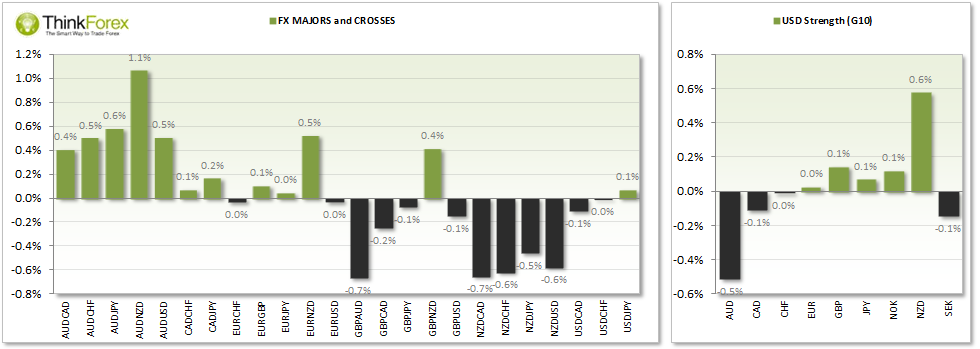

FOREX:

DXY Rikshaw Man Doji warns of sideways trading; Intraday shows potential for a bearish wedge to form (and create new highs) prior to retracement

AUDUSD Back above 94c but meandering around 0.945; Expecting a pullback but open to the idea of gain above 0.945

EURUSD Trades cautiously sideways; Bias is for a 'pop' higher towards 1.35 before losses resume

GBPUSD Edges lower but closed on 1.704 support; Seeking buy setups above 1.07

USDCAD Continues to hover above 1.07 with potential base forming to an upside break above bearish trendline from March '12 highs

USDCHF Rikshaw Man Doji warns of sideways trading, lower volume makes it less likely to be a retracement

USDJPY Neutral bias on D1

NZDUSD Bearish bias below 0.8650 on D1; See today's post for technical levels

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.