The Kiwi Dollar had a positive start to the week as it climbed higher in anticipation of an interest rate hike tomorrow. Then Chinese Data came out...

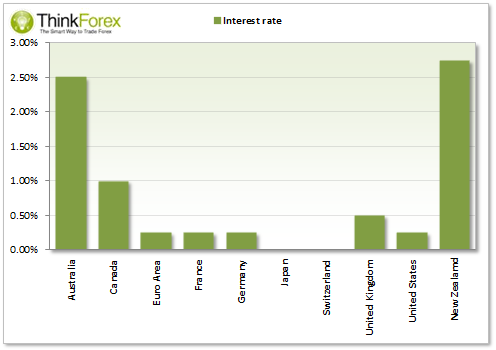

A cursory glance at the interest rates among G10 currencies and it is much easier to see what all of the fuss is about, and why NZDJPY is the 'go to ' carry trade among G10 crosses. With NZD having the highest interest rates and set to increase them again tomorrow we have seen steady Kiwi Dollar appreciation this week in the lead up to tomorrow's rate announcement.

Today's disappointing numbers from Australian CPI and Chinese PMI have pretty much annulled any speculation of RBA raising interest rates any time soon, which leaves NZ at the top of the leader board with a good chance of extending this lead tomorrow to 3%.

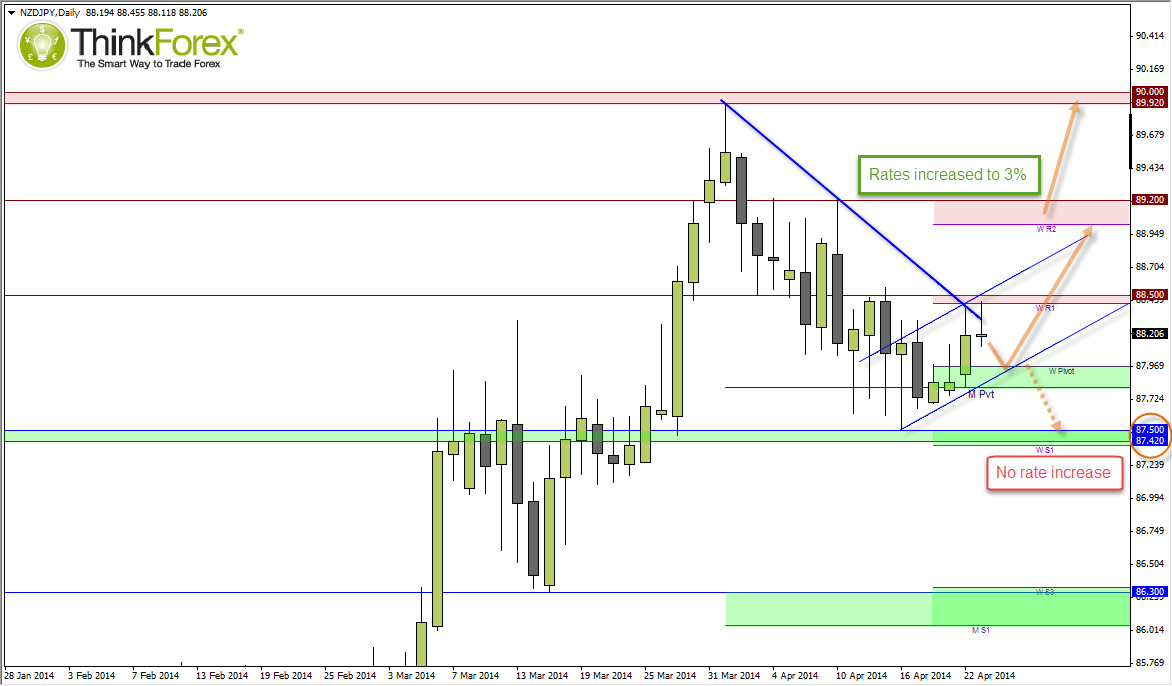

NZDJPY climbed to a 6-day high, no doubt fuelled by those awaiting rate hikes tomorrow, but the poor Chinese Data put the cross 'back in its box' below 88.50 resistance and 87.50. The aforementioned box has housed NZDJPY the past 9 trading sessions and my bet is we are witnessing a basing pattern before a resumption of the uptrend. If we can break above 88.50 resistance then I think we will be set for a run up to 90.

However there is a chance the rate hike is already priced into the market, so any decision to keep rates fixed could see NZD sell-off across the board and break key levels of support against USD and CAD. Even if this does happen I do not see it to have a lasting effect as the longer-term traders should keep their positions open, leaving only the short-term trades disgruntled with fixed a rate decision.

Potential scenarios

- Rates to 3%: 87.50 remains as a swing low and for price to target 89.20 and 90

- Rates fixed at 2.75%: NZDJPY sells off down to 87.50; A break below here opens up 86.30

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.