There has been much anticipation on tonight’s FOMC staff projections and FED speech, with many analysts and participants expecting the FED to drop ‘considerable time’ in a speech, to suggest the initial interest rate rise will indeed “rise sooner than later”.

Expectations require fulfilling...

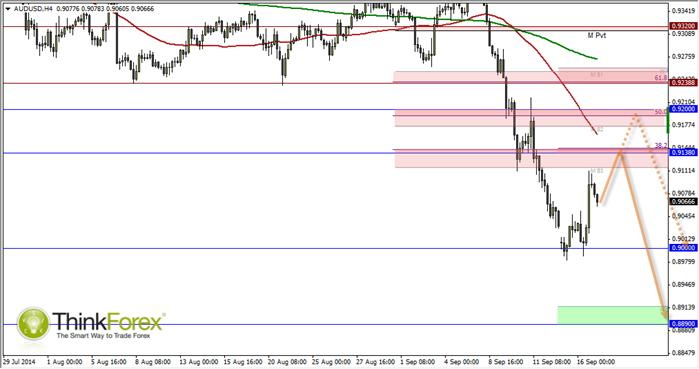

Of course with so much anticipation and expectations of these key words being dropped it does leave the market up for a huge disappointment if the FED fails to deliver, causing the Greenback to fall from current highs as a consequence. With the Greenback amid its best bull-run since May ’11 lows it wouldn’t hurt too much to see a USD pullback. This would help support the A$ above 90c which was successfully defended by bears booking profits, following the 6th consecutive session of declines. OECD cut growth forecasts for the US, so if FOMC Staff projections back up a further growth cut forecast tonight and the FED also fails to deliver a Hawkish tone then expect some rapid USD selling. AUDUSD could retest the 92c level, a key level for the bears to defend. However if this level holds as resistance then we can expect fresh short positions to be initiated as bearish traders seek to drive the Aussie below 90c. Like the RBA many traders believe the Aussie to be overvalued and it could be time for the A$ to catch up Iron Ore prices which sits at 5-year lows. Even of the FED do fail to deliver tonight I only see this as a temporary blip, so A$ gains should be short lived.

Alternatively - what of they deliver?

That said, the FED many finally deliver what traders have been asking for. A refined and more clear message of forward guidance. This should further fuel the bullish Greenback fire, putting extra pressure on the A$.

Technically:

The H&S shoulders confirmed below 92c targets 89c. Any rallies towards 92 are likely to attract bearish interest for the larger move down. This may provide bullish opportunities on intraday timeframes until a clear level of resistance has been respected.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders but failed to provide a boost to the US Dollar.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.