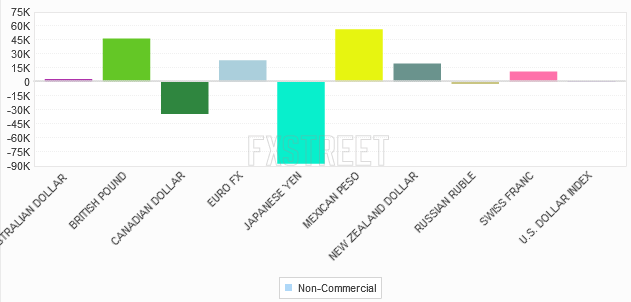

The latest data for the weekly Commitments of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that the ongoing bearish JPY position continues to be the broader theme. It also displayed that there is another theme of bullish sentiment towards the European currencies GBP, EUR and CHF which were the strongest of the majors. The dollar-bloc seemed to tire with neutral sentiment towards AUD, CAD and NZD, and also USD where speculators decreased their overall bullish bets to a flat position.

It has been about a 10k contract reduction in EUR to display the net long 23k contracts has now. Despite being the second largest gross long position among the majors, this closing of EUR long positions was one of the largest weekâ€overâ€week change the most recent of a three week straight dropping of the net positioning. A combination of low inflation rates and a relatively high exchange rate and the ECB's reaction to it, appears to have been the main culprit.

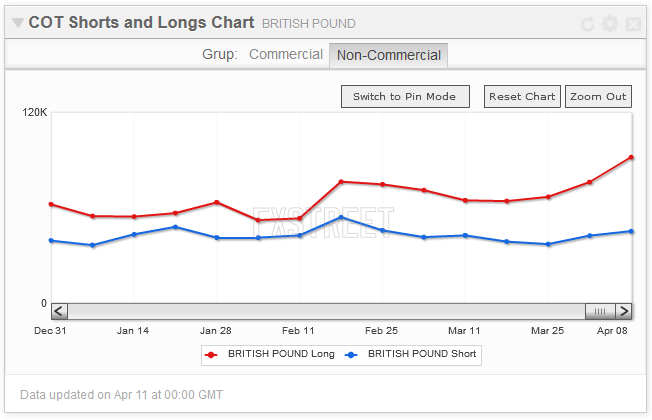

The biggest long exposure belongs now to the GBP which saws continued buying during the past four weeks. The long exposure is now paring the peaks of December 2012 (27.6k) and March 2011 (34.7k) in the futures only data series. A record figure is seen in the gross long number among non-commercials which is now at 91.6k experiencing a +15k acceleration in the most recent data.

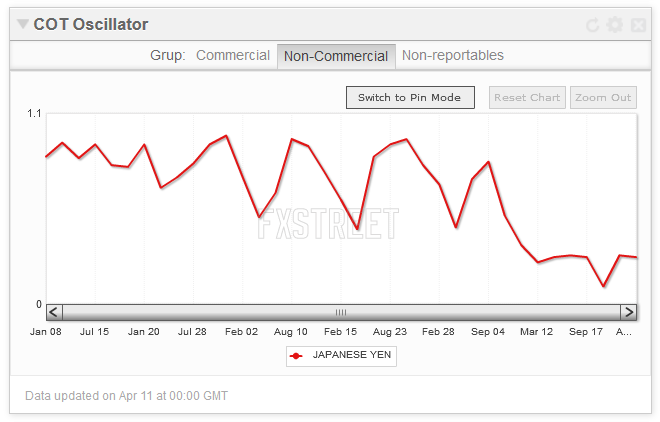

Both long and short JPY positions were scaled back due to risk aversion up to the time of data release but not so much as to threaten the support located at the 101.00 figure. The gross short yen positions is similar to the previous week (1st April) and prints -87.4k contracts. Still, the yen's gross short position is the largest among majors. The negative bias may be reduced in the next CFTC report if the USD/JPY reports a direct loss of immediate support due to current risk aversion climate. FXStreet's COT oscillator shows the building of a base and an intent of leaving the oversold zone.

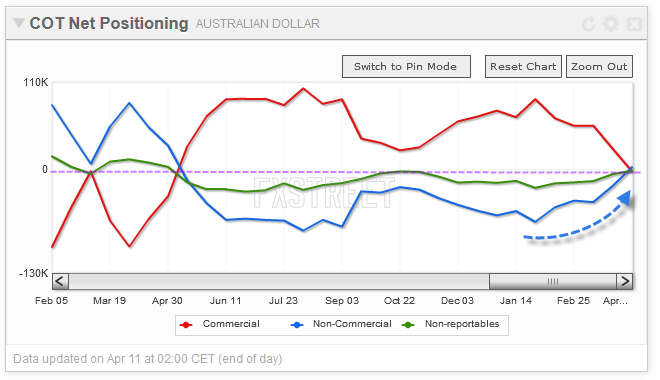

The net speculative Australian dollar futures position climbed to the long side (3.3k contracts from -4.8k) and so technically the bias turned bullish for the first time since May 2013.; But still this is a small position which does not necessarily imply a continuation of the current upward move.

According to CFTC, speculators are also reducing the net short in the Canadian dollar futures with a similar move as the Australian dollar, but the net positioning is still in the negative (-34.3k)

(Import the charts used in this report to your MyStudies suite of indocators)

What does it mean for traders? Accordingly to FXstreets weekly poll, the consensus forecasts on a 3-month horizon is for depreciation. However, the position data from CFTC is telling us the opposite, creating here an interesting dynamic to trade the EUR/USD. On the other side it is tempting to look for the greenback's losses to accelerate given the technical damage inflicted on the dollar and the recent decline in US interest rates.

The shift out of EUR to GBP can also be used to trade the EUR/GBP cross in the short-term, but don't loose attention to the fact that the theme is about European currencies right now. The net long at GBP is making a new high coupled with an OI which continues to grow. Although this can be considered a confirmation of trend strength, the exchange rate failed to rise above the high at 1.6820, a case for divergence between the data, which would imply an appreciation of the cross rate.

About Commitments of Traders

The weekly Commitment of Traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers, non-commercials (also called speculators) and nonreportable traders (usually small traders/speculators). The report is published every Friday and shows futures positions data that was reported as of the previous Tuesday.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.