Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

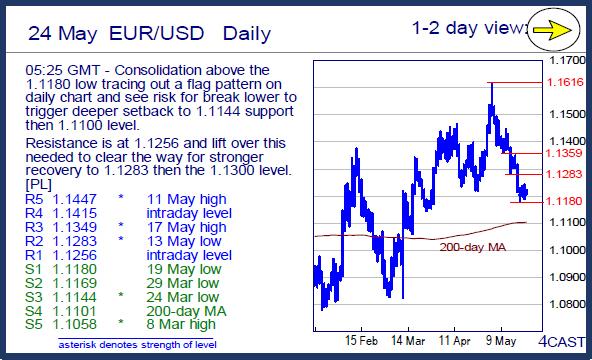

EUR/USD

Consolidation above the 1.1180 low tracing out a flag pattern on daily chart and see risk for break lower to trigger deeper setback to 1.1144 support then 1.1100 level. Resistance is at 1.1256 and lift over this needed to clear the way for stronger recovery to 1.1283 then the 1.1300 level. [PL]

EUR/CHF

Settling back in consolidation from the 1.1129 high though the downside still limited. Higher will see scope to target 1.1166 then the 1.1200, Feb high. Below the 1.1100 level see support at the 1.1065/57 area and break is needed to ease upside pressure and swing focus lower to the 1.1015 low. [PL]

USD/CHF

Recent strong rally stalled at .9923/27 highs and threatens a small top pattern on daily chart. Clearance needed to see further strength to target .9940 then the parity level. Divergence on intraday tools caution pullback with the .9863 and 200-day MA at .9836 to watch as break will swing focus lower to .9800 and .9763 support. [PL]

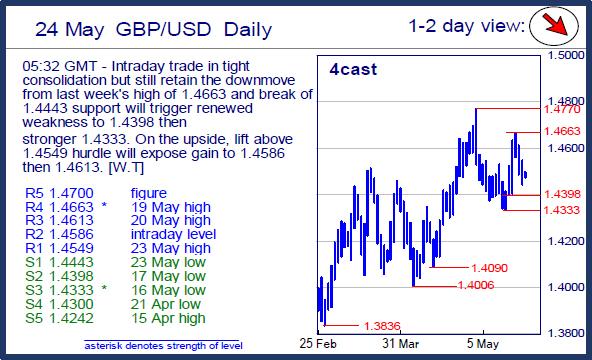

GBP/USD

Intraday trade in tight consolidation but still retain the downmove from last week's high of 1.4663 and break of 1.4443 support will trigger renewed weakness to 1.4398 then stronger 1.4333. On the upside, lift above 1.4549 hurdle will expose gain to 1.4586 then 1.4613. [W.T]

USD/JPY

Rejection from the 110.59 high to break the 109.65/40 support swing focus back to the downside. Break of the 109.00 level will see deeper pullback to the 108.72/23 area then 107.50 support. Resistance now at the 110.00 level then 110.59 high. [PL]

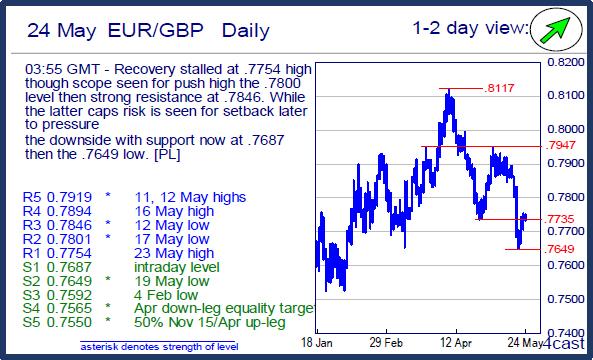

EUR/GBP

Recovery stalled at .7754 high though scope seen for push high the .7800 level then strong resistance at .7846. While the latter caps risk is seen for setback later to pressure the downside with support now at .7687 then the .7649 low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.