EUR/USD

Flat within a narrow range as probes below the 1.1100 level see the downside checked at 1.1072 low. Nearby see strong support at 1.1058 then the 200-day MA at 1.1042. Higher low sought for rally to retest the 1.1200 level then 1.1218 high. [PL]

EUR/CHF

Coiled within a narrow range following setback from the 1.1023 high of last week though the downside still limited with support at 1.0935. Would take break to expose 1.0893 low to retest. Higher low sought for retest of 1.1023 later and extend the 2-wk up-leg from the 1.0810 low. Break shift focus to 1.1061 and 1.1100 level. [PL]

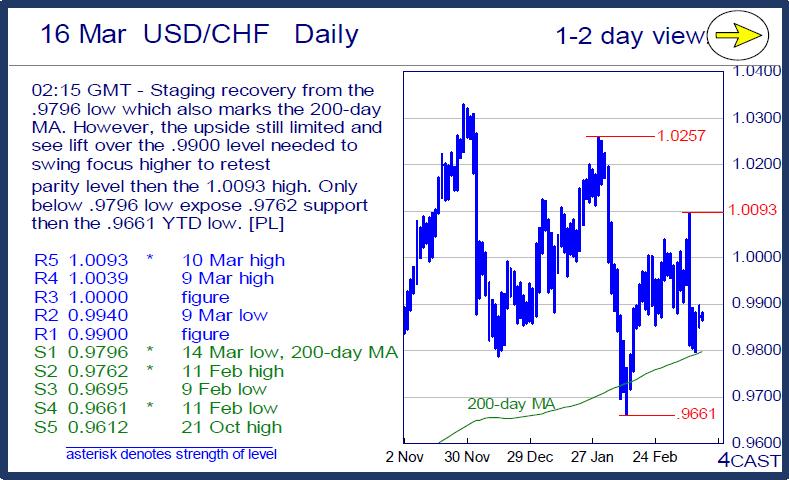

USD/CHF

Staging recovery from the .9796 low which also marks the 200-day MA. However, the upside still limited and see lift over the .9900 level needed to swing focus higher to retest parity level then the 1.0093 high. Only below .9796 low expose .9762 support then the .9661 YTD low. [PL]

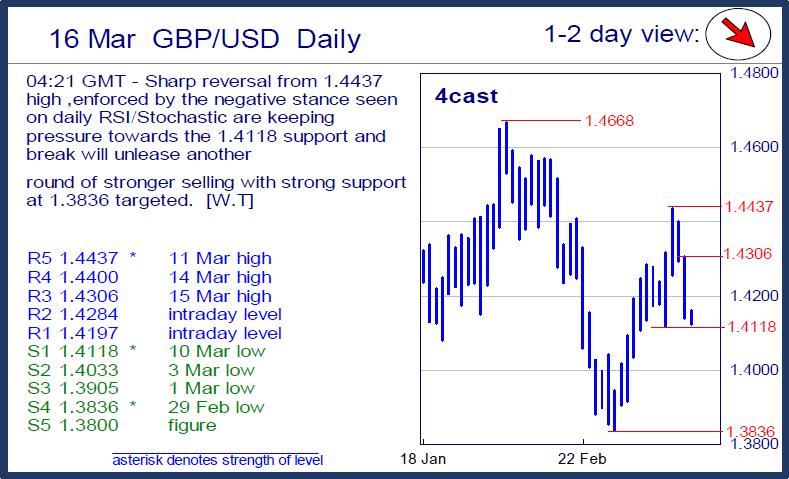

GBP/USD

Sharp reversal from 1.4437 high ,enforced by the negative stance seen on daily RSI/Stochastic are keeping pressure towards the 1.4118 support and break will unlease another round of stronger selling with strong support at 1.3836 targeted. [W.T]

USD/JPY

Bounce from the 112.61 support to regain the 113.00 level keep the past 2-wk ranging action in play within the 114.56/112.16 area. Would take break of the 112.00 level to see return to the 111.00 level and see risk for bear extension. Need lift above the 114.00 level to expose 114.56 and 114.87 highs to retest. [PL]

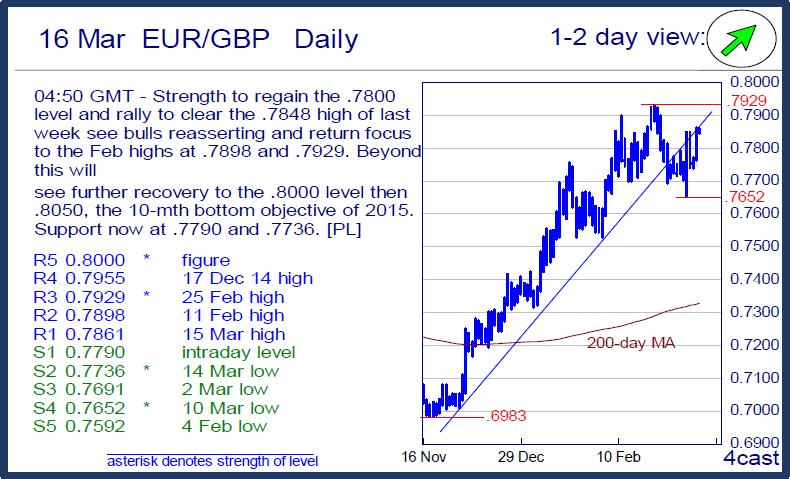

EUR/GBP

Strength to regain the .7800 level and rally to clear the .7848 high of last week see bulls reasserting and return focus to the Feb highs at .7898 and .7929. Beyond this will see further recovery to the .8000 level then .8050, the 10-mth bottom objective of 2015. Support now at .7790 and .7736. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.