EUR/USD

Drifting within a narrow range above the 1.1078 low following setback from the 1.1218 high. Below this see support at 1.1058/44 area which must hold to keep near-term focus on the upside. Clearing the 1.1218 high will see strength to target 1.1246 then the 1.1300 level and 1.1376 high. [PL]

USD/CHF

Probes below the .9800 level see the downside kept in check at the 200-day MA. Would take break to see further decline to .9762 and the .9700 level then the .9661 YTD low. Only bounce to regain the .9900 level will ease the downside pressure and set up scope for return to the parity level. [PL]

USD/JPY

Struggles to sustain probes above the 114.00 level and rejection from 114.14 high seeing rotation back to the 113.00 level. Below this will see setback to 112.61 then the 112.16 low. More ranging action seen for now while break of the latter will see return to the 111.00 level. [PL]

EUR/CHF

Lower in range from the 1.1023 high though the downside still limited with support at 1.0935. Would take break to expose the 1.0893 low to retest. Would need lift over the 1.1023 high to extend the 2-wk up-leg from the 1.0810 low. Break will see room for extension to target 1.1061 then the 1.1100 level. [PL]

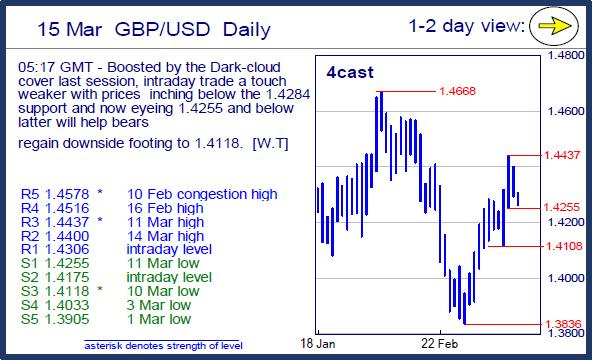

GBP/USD

Boosted by the Dark-cloud cover last session, intraday trade a touch weaker with prices inching below the 1.4284 support and now eyeing 1.4255 and below latter will help bears regain downside footing to 1.4118. [W.T]

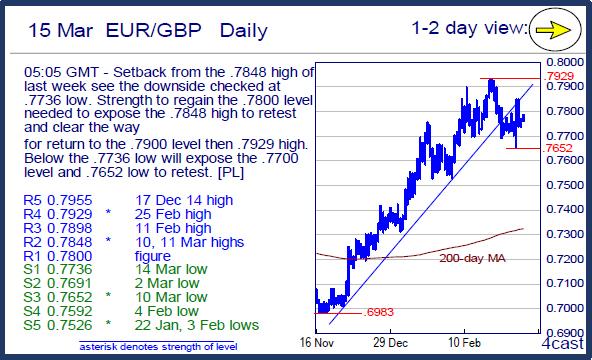

EUR/GBP

Setback from the .7848 high of last week see the downside checked at .7736 low. Strength to regain the .7800 level needed to expose the .7848 high to retest and clear the way for return to the .7900 level then .7929 high. Below the .7736 low will expose the .7700 level and .7652 low to retest. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.