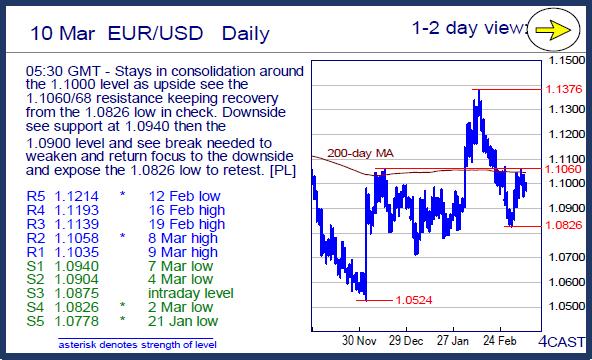

EUR/USD

Stays in consolidation around the 1.1000 level as upside see the 1.1060/68 resistance keeping recovery from the 1.0826 low in check. Downside see support at 1.0940 then the 1.0900 level and see break needed to weaken and return focus to the downside and expose the 1.0826 low to retest. [PL]

USD/CHF

Upside still limited above the parity level though the developing ascending triangle from the .9853 low keep pressure on the upside and see scope for further probes above the 1.0000 level. Lift over the 1.0039 high will clear the way towards 1.0074 and 1.0125. Only below the .9879/53 lows negate. [PL]

USD/JPY

Extending recovery from the 112.23 low and keep mkt confined within the 114.00/112.00 area. More ranging action seen for now and see lift over the 114.00 level needed to expose the 114.56 and 114.87 highs to retest. Support now at 112.75 then the 112.23/16 lows. [PL]

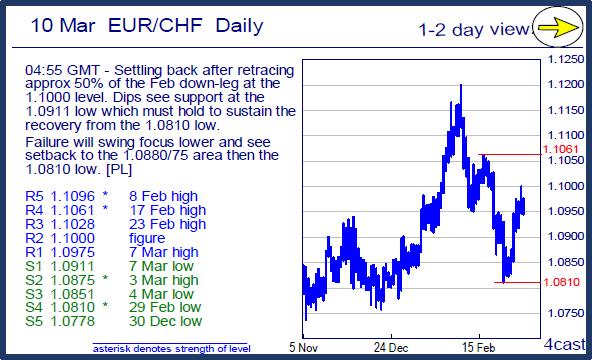

EUR/CHF

Settling back after retracing approx 50% of the Feb down-leg at the 1.1000 level. Dips see support at the 1.0911 low which must hold to sustain the recovery from the 1.0810 low. Failure will swing focus lower and see setback to the 1.0880/75 area then the 1.0810 low. [PL]

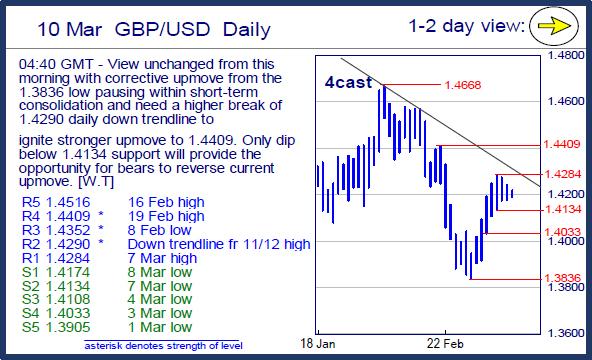

GBP/USD

View unchanged from this morning with corrective upmove from the 1.3836 low pausing within short-term consolidation and need a higher break of 1.4290 daily down trendline to ignite stronger upmove to 1.4409. Only dip below 1.4134 support will provide the opportunity for bears to reverse current upmove. [W.T]

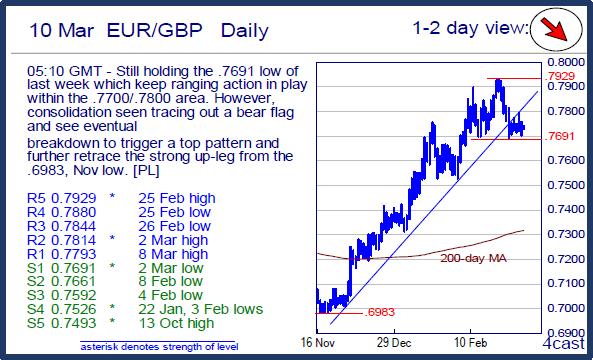

EUR/GBP

Still holding the .7691 low of last week which keep ranging action in play within the .7700/.7800 area. However, consolidation seen tracing out a bear flag and see eventual breakdown to trigger a top pattern and further retrace the strong up-leg from the .6983, Nov low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.