EUR/USD Daily

Settling back from the 1.0973 high to consolidate bounce from the 1.0826 low. Further strength not ruled out to retrace recent steep drop from the 1.1376 high. Higher will see scope to the 1.1000 level then strong resistance at the 1.1046/68 area. Dips see support now at 1.0912 and 1.0875. [PL]

USD/CHF Daily

Break of the .9949 support has seen setback to reach .9892 low though not follow-through as yet which keep the .9871/53 support out of reach for now. Would take break to trigger deeper pullback. Upside see resistance now at .9949 then the parity level and 1.0038 high. [PL]

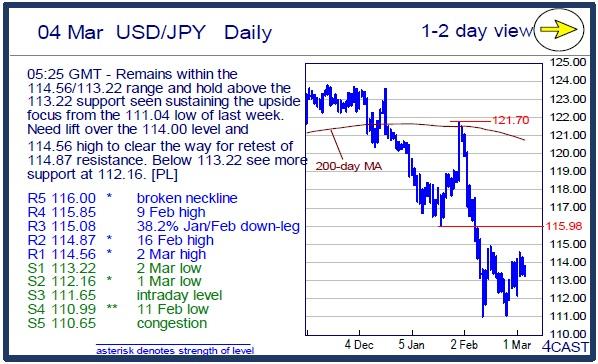

USD/JPY Daily

Remains within the 114.56/113.22 range and hold above the 113.22 support seen sustaining the upside focus from the 111.04 low of last week. Need lift over the 114.00 level and 114.56 high to clear the way for retest of 114.87 resistance. Below 113.22 see more support at 112.16. [PL]

EUR/CHF Daily

Higher in consolidation above the 1.0810 low though the resulting pennant pattern see risk for break to further extend the drop from the 1.1200, Feb high. Below the 1.0800 level will expose the 1.0778/56 and 1.0737 lows. Resistance now at 1.0885/900 area and lift over this needed to see room for stronger recovery. [PL]

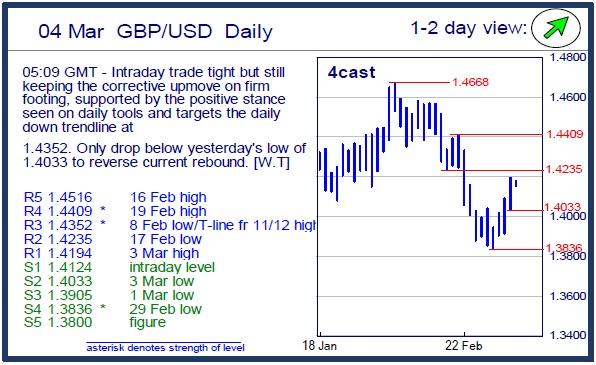

GBP/USD Daily

Intraday trade tight but still keeping the corrective upmove on firm footing, supported by the positive stance seen on daily tools and targets the daily down trendline at 1.4352. Only drop below yesterday's low of 1.4033 to reverse current rebound. [W.T]

EUR/GBP Daily

Steady in consolidation above the .7691 low but upside seen limited with resistance now at .7758 and .7814. Lower high sought to further pressure the .7696/66 support and where break will trigger a top pattern and see deeper setback to retrace strong up-leg from .6983, Nov low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.