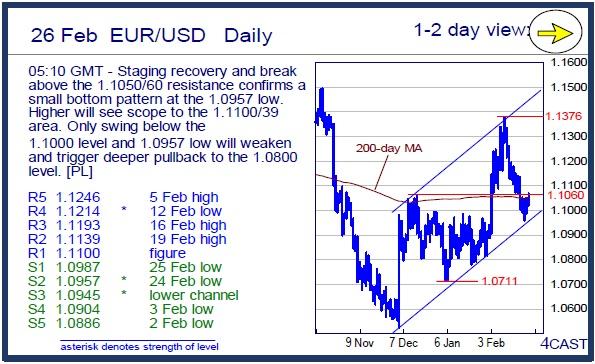

EUR/USD Daily

Staging recovery and break above the 1.1050/60 resistance confirms a small bottom pattern at the 1.0957 low. Higher will see scope to the 1.1100/39 area. Only swing below the 1.1000 level and 1.0957 low will weaken and trigger deeper pullback to the 1.0800 level. [PL]

EUR/CHF Daily

Tracing out a small bottom pattern following bounce from the 1.0865 low. Neckline resistance is at 1.0942/48 area and clearance will trigger stronger recovery back to the 1.1000 level. Support now at the 1.0900 level ahead of the 1.0865 low where break is needed to trigger deeper pullback. [PL]

USD/CHF Daily

Pressure returning to the downside after bounce was checked at the .9953 resistance. The .9853 mid-wk low now at risk and break will see return to the .9800 level then the 200-day MA at .9762. Resistance at .9918 and .9953 now protecting the 1.0004 high. [PL]

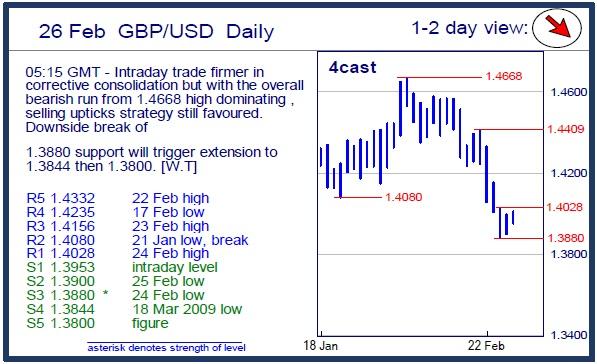

GBP/USD Daily

Intraday trade firmer in corrective consolidation but with the overall bearish run from 1.4668 high dominating , selling upticks strategy still favoured. Downside break of 1.3880 support will trigger extension to 1.3844 then 1.3800. [W.T]

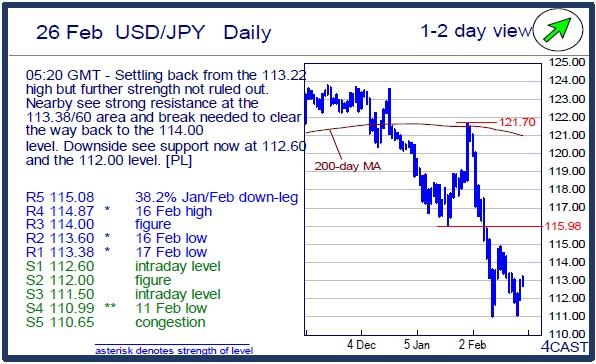

USD/JPY Daily

Settling back from the 113.22 high but further strength not ruled out. Nearby see strong resistance at the 113.38/60 area and break needed to clear the way back to the 114.00 level. Downside see support now at 112.60 and the 112.00 level. [PL]

EUR/GBP Daily

Settling back from the .7929 high to consolidate the up-leg .7708 low and dips see support now at .7845 then the .7800 level. Higher low sought to further pressure the upside later to target .7955 then the .8000 level. Beyond this will see scope to .8050, the 10-mth base measuring objective. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY drops to test 154.00 on Japan's intervention warnings

USD/JPY extends losses to test 154.00 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone. Focus shifts to more Fedspeak and US data.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.