EUR/USD Daily

Staging recovery from the 1.1071 low which stands just above strong support at the 1.1060, Dec high. Failure to hold the latter will trigger deeper pullback to the 1.0985 support. Resistance now at 1.1160 then the 1.1200/14 area. Only above the latter will revive upside focus and see return to the 1.1300 then 1.1376 high. [PL]

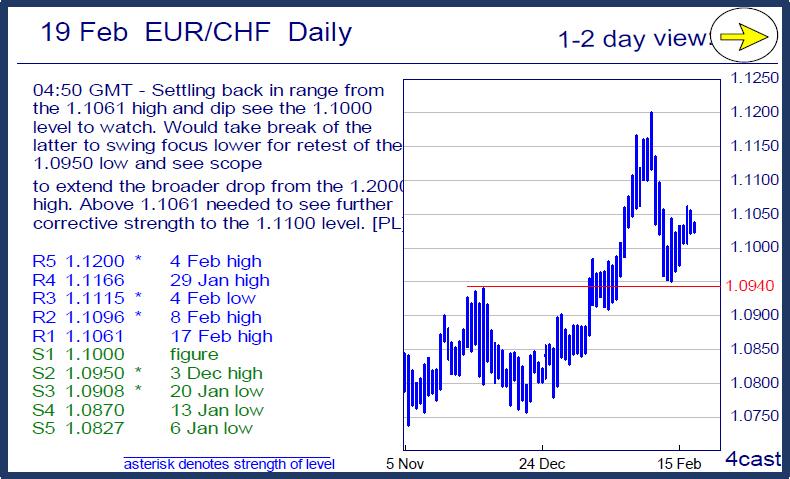

EUR/CHF Daily

Settling back in range from the 1.1061 high and dip see the 1.1000 level to watch. Would take break of the latter to swing focus lower for retest of the 1.0950 low and see scope to extend the broader drop from the 1.2000 high. Above 1.1061 needed to see further corrective strength to the 1.1100 level. [PL]

USD/CHF Daily

Settling back from the .9969 high which retrace approx 50%of the drop from the 1.0257, later Jan high. Risk now seen for setback below the .9900 level to the .9896/90 support and where break will confirm a top at the .9969 high and return focus to the downside. Resistance now at .9942 then .9969 high. [PL]

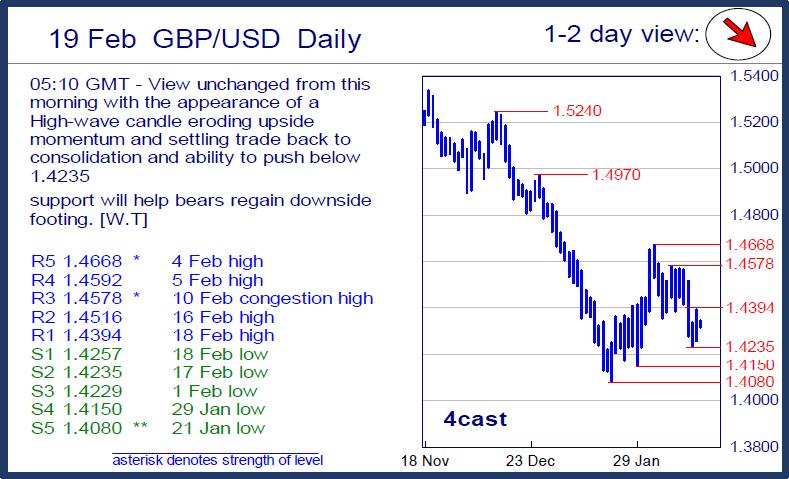

GBP/USD Daily

View unchanged from this morning with the appearance of a High-wave candle eroding upside momentum and settling trade back to consolidation and ability to push below 1.4235 support will help bears regain downside footing. [W.T]

USD/JPY Daily

Failure to hold the 113.00 level seeing deeper pullback from the 114.87 high. Lower see scope to the 112.50 and 111.57 support then the 110.99 low. Would need to regain the 114.00 level to ease downside pressure and clear the way for retest of 114.51 and 114.87 high. [PL]

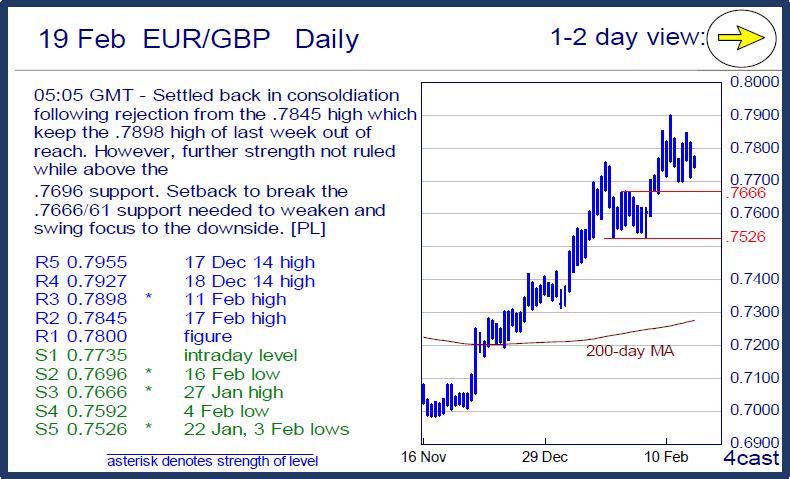

EUR/GBP Daily

Settled back in consoldiation following rejection from the .7845 high which keep the .7898 high of last week out of reach. However, further strength not ruled while above the .7696 support. Setback to break the .7666/61 support needed to weaken and swing focus to the downside. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.