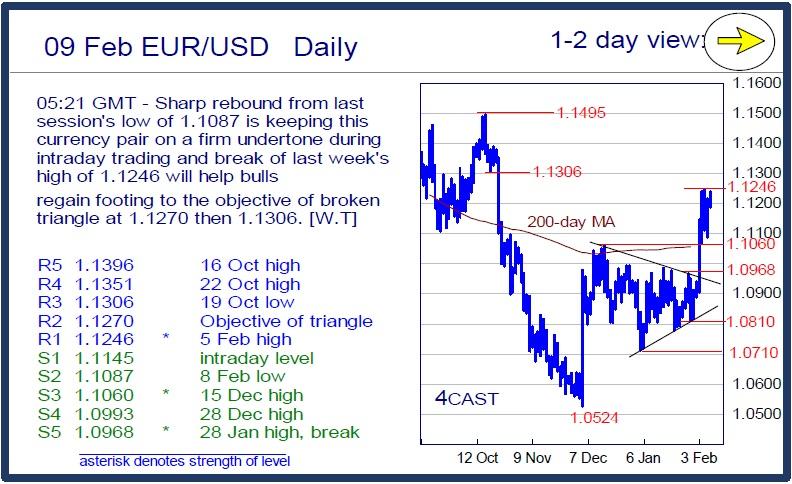

EUR/USD Daily

Sharp rebound from last session's low of 1.1087 is keeping this currency pair on a firm undertone during intraday trading and break of last week's high of 1.1246 will help bulls regain footing to the objective of broken triangle at 1.1270 then 1.1306. [W.T]

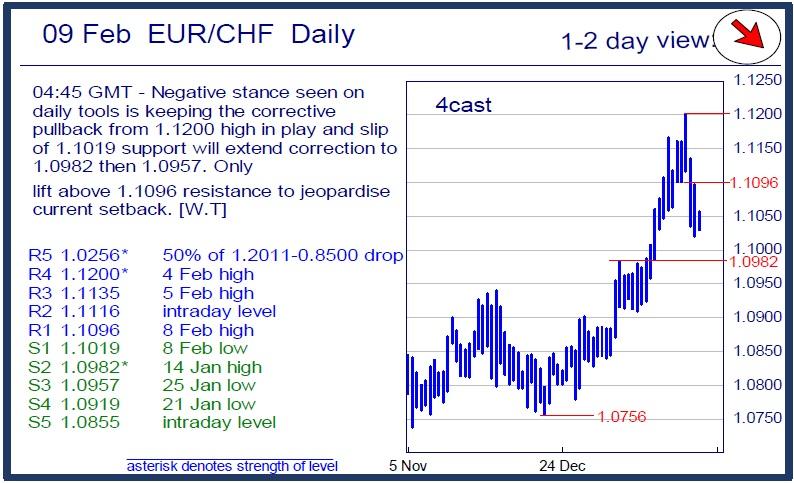

EUR/CHF Daily

Negative stance seen on daily tools is keeping the corrective pullback from 1.1200 high in play and slip of 1.1019 support will extend correction to 1.0982 then 1.0957. Only lift above 1.1096 resistance to jeopardise current setback. [W.T]

USD/CHF Daily

Intraday trade extending the downmove from 1.0257 high and eyeing the strong support at 0.9786 and with daily technical tools intruding into oversold territories, would expect the latter to put up a strong fight to current downmove and probably trigger a strong rebound from the latter. [W.T]

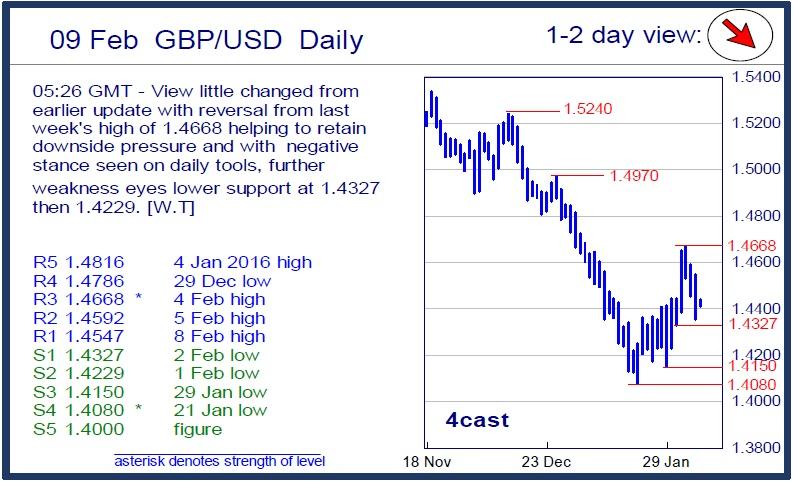

GBP/USD Daily

View little changed from earlier update with reversal from last week's high of 1.4668 helping to retain downside pressure and with negative stance seen on daily tools, further weakness eyes lower support at 1.4327 then 1.4229. [W.T]

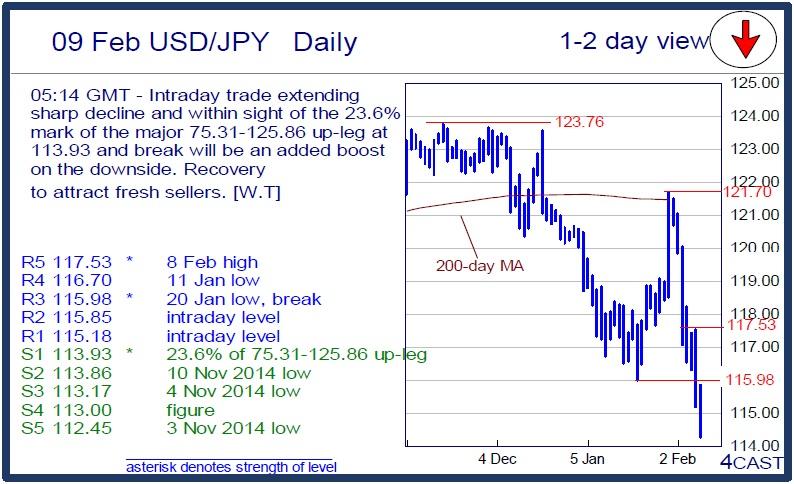

USD/JPY Daily

Intraday trade extending sharp decline and within sight of the 23.6% mark of the major 75.31-125.86 up-leg at 113.93 and break will be an added boost on the downside. Recovery to attract fresh sellers. [W.T]

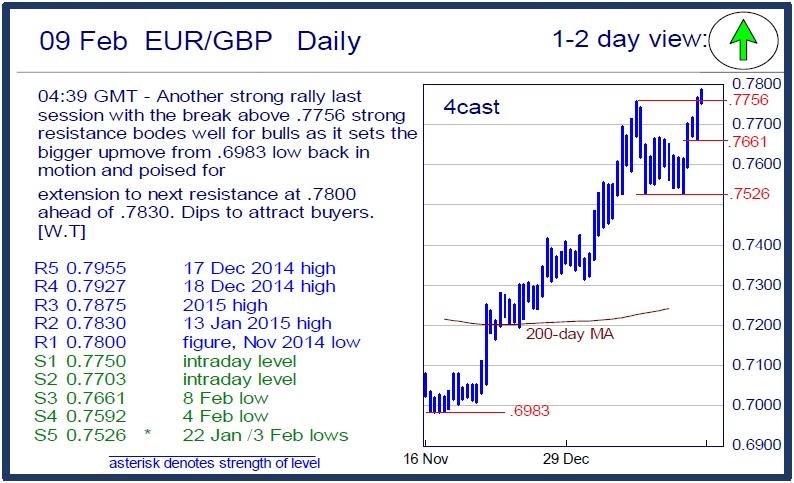

EUR/GBP Daily

Another strong rally last session with the break above .7756 strong resistance bodes well for bulls as it sets the bigger upmove from .6983 low back in motion and poised for extension to next resistance at .7800 ahead of .7830. Dips to attract buyers. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.